Summary

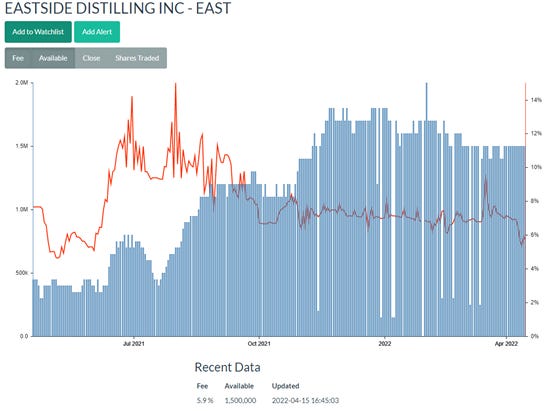

Eastside Distilling looks like an attractive short at the current price given its uneconomical business model, negative growth, and current liquidity/solvency crisis. There are very identifiable catalysts over the next 6 months that can push the company into bankruptcy. There might also technical factors that adds selling pressure to the stock, further juicing the risk/reward. Despite these issues, there remains a large amount of shares available for borrow at relative low cost.

At its current cash burn rate, EAST will run out of cash by June 2022

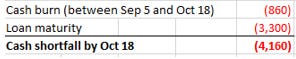

EAST faces a sizable debt maturity in October, which combined with the company’s expected burn rate between June and October implies a $4 million cash shortfall

Potential selling pressure from TQLA’s exercising of its $1.20 stock warrants limit upside selling pressure

There are numerous red flags with the executive team and board of directors

Business: stuck in a vicious cycle where lack of scale begets a lack of scale

Eastside Distilling is a micro-cap company with two business units: Craft Canning, and Spirits.

Craft Canning is a canning and bottling business that serves breweries in the Pacific Northwest, while the Spirits business represents a portfolio of niche Spirits brands.

These two businesses boast a glorious history of sizable losses and lackluster/negative growth. The core problem is that the company is sub-scale, which creates a vicious cycle where a lack of scale begets a lack of scale, due to the lack of available capital pool to invest in growth.

For perspective, the company generated less than $3 million of gross profit in 2021 (down from $3.6 million in 2020). The company’s general and administration expenses alone were nearly $7 million in the same period. These are expenses like rent and utilities, depreciation, and insurance. It is likely that EAST would have $0 or even negative profit pool to invest in any growth endeavor after netting out these necessary expenses. This makes it very difficult for EAST to dig itself out of its current situation as a negative contribution profit pool makes it hard for the company to invest in growth to extricate themselves from the current predicament. It is a vicious cycle.

By the way, executive compensation represents nearly $1 million of cost in 2021, and the board of directors received $400K as well. This does not include travel and entertainment expenses. The executive team and board of directors compensation alone represent two-third of EAST’s gross profit pool.

EAST has lost about $1.5 to $2 million in operating losses every quarter over the last 2 years, and about $1.2 million in interest expense per year

Balance sheet: limited cash runway with massive debt

On top of a weak financial profile, EAST also has a very weak balance sheet. The company has $3.3 million of cash as of end 2021, but over $17 million of debt.

Time is running out: cash to runout by June with sizable debt maturity in October

To starve off its liquidity crisis, EAST managed to raise an additional $2 million since the end of December quarter from TQLA LLC at a 9.25% interest rate, as well as a commitment fee worth a couple percent of interest, with an option that TQLA could advance another $1 million to EAST within 12 months. TQLA also get a ton of equity warrants on top.

I believe most of the debt raised has and will be used to pay-off the Live Oak Loan that was due on November 11, 2021. I believe this loan is unofficially in default but Live Oak, as of 28 Feb 2022, has agreed to forbear enforcement of the loan. Live Oak could demand repayment any time, and EAST will be obligated to pay within 30 days. The company had $2.8 million of Live Oak loan outstanding as of 31st December, and $1.96 million as of 21st March.

In fact, EAST was forced to sell 800 barrels of its inventory in early February to raise cash to pay off some of the Live Oak loan, showing evidence of severe liquidity issues.

Assuming the Live Oak Loan is paid off, I estimate that EAST has about $2.2M of cash left as of 31st March 2022.

EAST might get another $1 million from TQLA, but that would only delay the inevitable, giving them cash runway till early September.

Moreover, EAST has a $3.3 million promissory note that will be due on October 18, 2022. This implies a $4 million cash shortfall by October 18, 2022. Around $1 million of cash burn between June and mid-October, and $3.3 million of debt due!

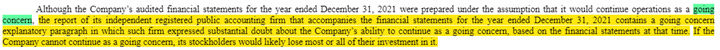

Given the company’s sub-scale financial position, history of consistent losses, massive debt load, and upcoming debt maturity, I believe it is likely that EAST is at risk of being a going concern within the next 6 months.

It turns out I am not the only person that thinks EAST is a going concern. The company’s accounting firm has also “expressed substantial doubt about the company’s ability to continue as a going concern” and “if the Company cannot continue as a going concern, its stockholders would likely lose most or all of their investment in it.”

Selling pressure

On top of a loan with 9.25% interest rate with sizable commitment fee, TQLA also gets 1.7 million equity warrants unit with 5-year duration at a $1.20 strike for their 1-year loan. This suggests a 20 to 30% option-adjusted cost of debt for a loan secured against the company’s entire asset base. By the way, TQLA is controlled by Stephanie Kilkenny who sits on the board of director…So a board of director is lending money to EAST at a 20 to 30% option-adjusted interest rate. Nice.

There are several ways that we could interpret this equity warrant issuance.

Management is not credible as they issued this warrant 1 month after telling shareholders in late Feb that they will not be diluting shareholders any further

The warrants are needed to get TQLA, controlled by a board of director, interested in the financing which does not spell good news. What does it tell you when your board will only lend money to their company at a 20-30% rate?

This is a way for EAST to raise some equity financing via a back-handed method. TQLA would give cash to EAST and then sell their shares to the public market

The right answer is probably a mix of these interpretations. Regardless, this does not bode well for the company long-term, and suggests there might be selling pressure above the $1.20 range as TQLA aggressively sell shares to raise financing for EAST.

Red flags

There are several other red flags with EAST.

CEO Paul Block stepped down as CEO in Feb 2022 (no reason was provided), with the CFO now serving as the CEO

TQLA, the company that lent $2 million to EAST, is controlled by Stephanie Kilkenny who is on the board of director. Stephanie was the former managing director of Azunia Tequila, which was sold to Eastside for nearly $15 million. TQLA loan to EAST is secured on the company’s assets. I wonder if there is something insidious going on under the surface…

Stephanie Kilkenny also sold nearly all her common shares in EAST 6 months ago

What can be done?

Management will likely do all it can to starve off the liquidity situation. This includes trying to delay the Live Oak payment/maturity, selling inventory, firing people, and further debt/equity issuance.

Further debt issuance seems unlikely given that the secured loan was issued at a 20 to 30% options-adjusted interest rate. As such, I do not think there is much EAST can do at this point…although there are definitely schmucks in this world with little financial knowledge that can be duped – for instance, management was able to dupe Crater Lake Pte Ltd into investing $2.5 million into a convertible preferred with a strike price of $3.10, and 6% dividend with PIK toggle. What a steal!

My guess is that equity issuance is the only way forward and that would add financial pressure to the stock making it lucrative for a short seller.

Bull case?

The bull case, at this point, seems to be entirely predicated on a newly bought Hinterkopf D240.2 digital printer that would allow EAST to expand its custom canning operations. The printer is supposed to come in production by April 1st.

Hart Print, which is a company with similar technology with a 30 million can production capacity, was sold to Ardagh for $5 million. EAST’s printer has a production capacity of 25 million cans.

The large can manufacturers (Ball, Crown, and Ardagh) all generate roughly 1.5 to 2c per can of profit, and these are companies with hundreds of billion of annual can production. How would EAST be able to out-earn these scaled companies?

What gives the bulls confidence that this printer would be the company’s saving grace? I believe the burden of proof is on management, and I believe we will not see any evidence in the Q1 report, probably not in the Q2 report as it takes time for the business to scale, and it would be too late by Q3.

Also, it looks like some in the earnings call are calling for a second printer? The company hasn’t even scaled its first printer and show unit economics, has massive liquidity issues over the next 6 months, and now some are calling for a second printer?

Valuation

So how bad can it get? I think the answer is $0 or close to $0 through equity issuance. The company has close to negative book value, burns globs of cash every quarter, and has massive debt maturity.

Borrow

Despite the liquidity crisis, there is still a sizable amount of shares that could be borrowed (assuming for one’s PA) from the company today at a low cost.

Lastly

This is my spite store.

So what you are saying is that Stephanie Kilkenny is a genius

very well argued and written piece. will be very interesting to see where this company is at in 6 months. feels like a restructuring situation in the making