Thesis Summary

Company: Owens & Minor, Inc

Ticker: OMI

Current Price: $41.50

Target Price: $25 (-40%)

Upside Risk: $56 (+35%)

Why: Profits in “Global Products” should decline over the next two years as it emerges from a period of over-earning in 2020 and 2021, resulting in a collapse in earnings and valuation

When: Should show evidence in 1Q/2Q2022 - once investors see that Global Products profit is shrinking and start applying a low-growth multiple to normalised earnings.

Factor Exposure: Value, Covid-beneficiary, negative earnings revision

The Brief

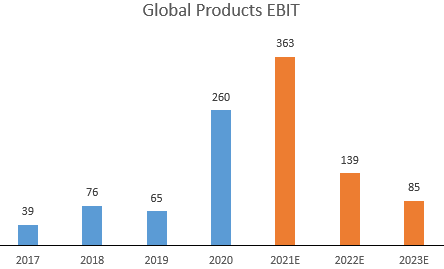

The decline in Global Products should drag earnings down from $544 million in 2021 to $313 million in 2023, which is 46% below consensus expectations.

Management was able to convince investors and the sell side that their earnings level is sustainable, but this can be easily discredited by some primary research and first principle thinking. At the end of the day, OMI sells largely commodity products - it’s inconceivable that they’d be able to sustain a 20% ROIC when they were barely scraping 7% just a couple years ago

Furthermore, the Apria acquisition is evidence that management is trying to diversify away from its legacy business (Global Solutions Distribution and Global Products manufacturing)

Management appears to agree with the assessment that the shares are overvalued with aggressive insiders selling between $35 and $45

For more background into their business, please go to the end of this article. Otherwise, let’s dive straight into the thesis.

Thesis

OMI is significantly over-earning in its Global Products division. I foresee earnings collapsing in 2022 and 2023 as the US emerges from Covid and the supply chain crisis eases.

In actuality, earnings already are declining, but, management managed to convince investors that the decline is transitory and growth will resume in 2022. When this growth fails to materialise, the market will re-price the asset to $25 per share (-40% from current price of $41.50). I expect this will happen as soon as 2022 Q1-Q2, where OMI will miss estimates.

Here’s what I think:

Global Products is getting a temporary earnings boost due to Covid and the current supply chain crisis and will normalise

More than 100% of OMI’s profit growth over the last two years was driven by Global Products, a manufacturing division that saw two big tailwinds:

Key products (i.e.. face masks, examination gloves) soared in demand during Covid

The supply chain crisis throttled the flow from their Asia-based competitors, giving them a temporary volume boost and cost advantage in logistics

Profit is already declining but management is trying to pin this entirely on “glove timing”. OMI buys ~50% of their gloves from Asia and it takes 2 to 4 months for those gloves to reach the US. Given the lag between buying and selling, OMI is effectively long glove prices. With glove prices coming down, OMI is incurring a loss but management contends that this is one-off and will cease when glove price stabilises

I concede that “glove timing” had an impact on profit, but management failed to highlight that they manufacture the remaining half of their gloves domestically - sliding glove prices will directly impact this too, with no room for recourse. Management also failed to communicate that their face masks and other PPE products were also over-earning and will likely come down in due time

Sell side analysts flew with the numbers that management was dishing and modelled an inflection in 2022. Will this come to pass? I should think not.

High correlation exists between Global Products quarterly EBIT growth and other pure-play PPE companies. If this correlation persists (and I have no reason to see why it should not), consensus numbers will wind up wrong and profits will continue to shrink

Pure play PPE manufacturers like Top Glove have already seen their quarterly profit return 2019 levels (link, link), and share prices for other pure-play PPE manufacturers have collapsed. I believe OMI bucked the trend as they were able to obfuscate the underlying reason behind the earnings growth and couch it under “a successful management turnaround”

The acquisition of Apria doesn’t carry much industrial logic and even invalidates the bull case

OMI announced the acquisition of Apria in January. It was an all-cash transaction financed by debt. The valuation was reasonable at 14 to 15x 2021 EBIT, but what they’re buying is ultimately a low growth asset in a very fragmented industry

In the M&A call, management specifically mentioned limited cost synergies, and was unable to defend the deal beyond it being “accretive to EPS”. That was feeble, to say the least. Being accretive to EPS doesn’t translate to being accretive to equity value.

I can’t see any other strategic reason to buy Apria, other than an attempt to circumvent the inevitable drop in earnings post-Covid. Sans this acquisition, management would be left with a struggling distribution and manufacturing business

This acquisition also invalidates the bull case that OMI will replicate Medline’s success and vertically integrate their way to indomitability by acquiring other manufacturing assets. This acquisition would pile so much debt onto their balance sheet that that thesis is now a pipe dream.

Moreover, if there were other viable manufacturing assets that they could acquire, they wouldn’t have locked arms with Apria, a home health business centred on home delivery of medical supplies and equipment (where did this come from?). Why did they not pick something more germane to their core business?

Apria could be over-earning due to Covid, and OMI might have bought an asset that is reasonably priced based on current earnings but expensive on normalised earnings

Apria was earning around $60 million in EBIT in 2019 and this nearly doubled to $110 million 2021 - yes, cost control would have played a part, but Apria’s respiratory business also likely benefited from Covid

It was also interesting that Blackstone was willing to IPO Apria at what seemed like a low valuation in April 2021 at 12x EBIT. Furthermore, they have been consistently selling shares in the 12x EBIT range, could this be a red flag?

Valuation of Apria’s closest comps have also contracted by nearly 20% since the deal was announced, making the deal relatively more expensive

Timing

The stock should work once investors begin to question the sustainability of OMI earnings, which should happen after earnings fail to inflect in the first and second quarters of 2022.

In the near-term perspective, I think there will be a fair amount of selling pressure as I believe there are bulls that will be happy to exit this asset if it goes to $45, given that their thesis of OMI replicating Medline is now broken. Moreover OMI is tied to the Covid-factor and so should see selling pressure as capital moves out of Covid names and into reopening assets.

Valuation

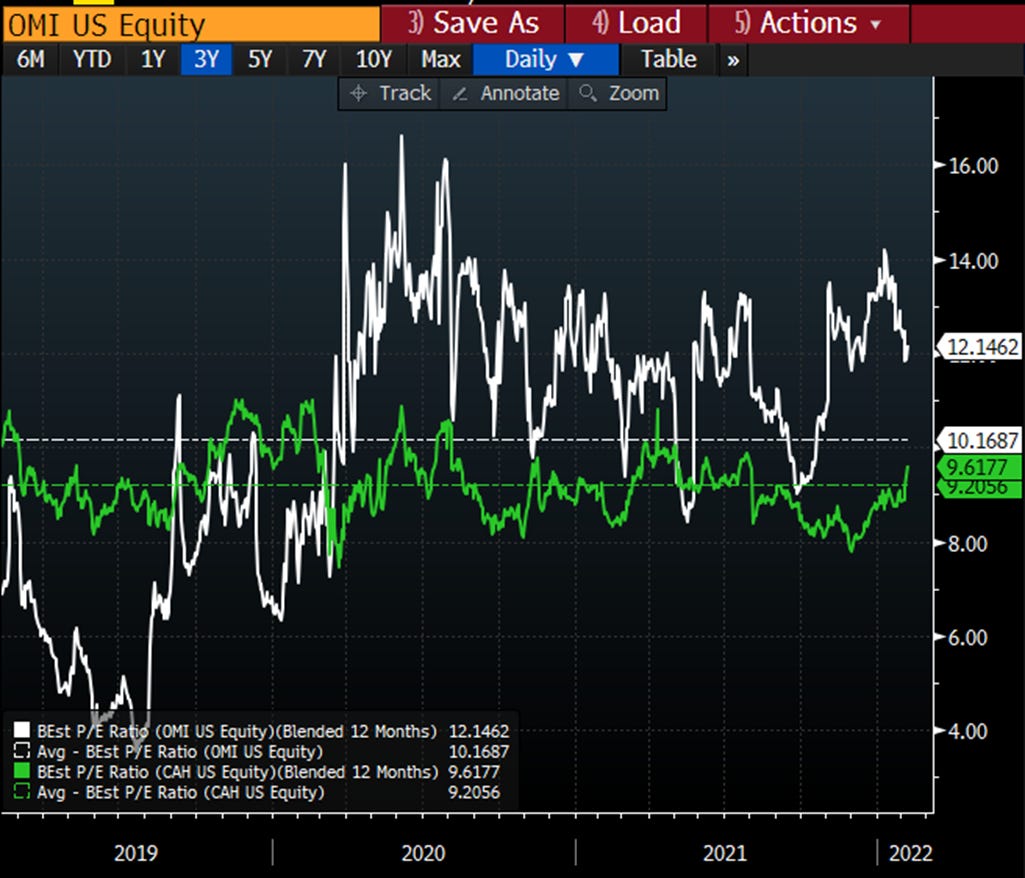

OMI should trade down to $25 (-40%) once investors better appreciate that current earnings cannot be extrapolated and will decline. This is based on 12.5x multiple of OMI’s 2023 EPS estimate of $2 per share. There could be more downside given that Cardinal Health trades at 9.6x P/E, which if happens would imply a $19 share price.

Moreover OMI would be dangerously over-levered, especially if Apria were indeed over-earning. It would take over a decade for OMI to repay its obligations, making the credit risky and the equity at risk.

Management Incentive

Another red flag is the consistent selling by management in the $35 to $45 range.

Bull Case

The projections laid out by management are aggressive and have a low probability of success. Nonetheless if OMI is able to pull a rabbit out of the hat and show multiple evidence that the 2026 guidance is achievable, I think the stock will rerate to $56.

This is based on a DCF assuming earnings hit their 2026 targets discounted back at 15%. I use 15% as I think bulls would want a 15% IRR on this asset today as the burden of proof is very high.

Pre-Mortem (i.e. how we lose money)

OMI manages to lock in contracts for the manufacturing business and is thus able to maintain high profits for longer than expected

This is the key risk to the thesis over the next 6 months

It is possible that hospitals were so desperate for masks and gloves that they signed up for long-term contracts at elevated prices to gain access to OMI inventory

Even then, this would apply similarly to other manufacturers, yet earnings for companies like Top Glove and Alpha Pro are already collapsing

It would also leave a very bad taste to customers if OMI decided to maintain extortionary prices even as market prices return to normal levels.

Apria and Byram are much better businesses than expected and OMI is able to roll-up the industry

Apria and Byram are decent businesses that OMI can use as platforms to roll-up the industry, using capital from the distribution and manufacturing business

AHCO did this to some success, although it looks like the market is starting to penalise the asset for poor organic growth

While certainly possible, I think the market will re-price the asset to the $25 range before any roll-up benefits will be realised. The Apria deal is expected to close in 1H2022 and it will take several quarters, if not years, to digest the deal operationally and financially, pushing out potential M&A activity

OMI is able to sell the struggling distribution business to a strategic buyer, although that seems unlikely as there isn’t a logical buyer and would kill management’s guidance

Business Background

OMI has three separate business operations in the US. They are:

A distribution business that supplies medical supplies to hospitals, usually through GPOs (Group Buying Organisations)

Negotiation power is poor as the US GPO scene is dominated by 3 big players that represent the majority of revenue

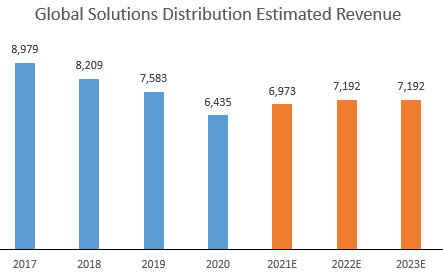

Distribution has been shrinking over the last 5 years as OMI is structurally disadvantaged compared to its competitors Cardinal Health and Medline. This is because competitors are more vertically integrated than OMI (>50% versus <10% for OMI), and therefore willing to operate the distribution business as a loss leader to gain volume for their higher margin manufacturing business. I think it will be difficult for OMI to turn this business segment around as they would not be able to overcome their structural cost disadvantages. There are few relevant assets that could be acquired

OMI doesn’t split out its numbers perfectly, but I believe the distribution business has been shrinking for a few years now and is now unprofitable. Covid did not help the distribution business as it reduces elective procedures

A manufacturing business (known as Global Products) that came about from their acquisition of Halyard’s Surgical and Infection Prevention (S&IP) segment back in 2018. Most of their manufacturing is done in the US, compared to many other players that manufacture competing products in low-cost Asian economies. As you can imagine, selling commodity face masks and surgical drapes and gowns is not a high margin business, especially if you are competing against players with superior cost structures

Shown above is the revenue mix of Halyard’s S&IP business in 2017. The Exam Gloves and Facial Protection division is likely much larger today due to Covid The Home Health business segment - a combination of Byram (acquired in 2017) and Apria (in the process of getting acquired by 1H22). Both provide home delivery of medical supplies and equipment. It’s admittedly a decent business but operates in a low-growth fragmented industry and unlikely to bail out the distribution and manufacturing businesses

Please reach out to me on Twitter or newmooncap@outlook.com for my model or more information. Happy to discuss the idea and please let me know if I am wrong or missing something.

I will be regularly publishing content. Please subscribe below to receive content as they arrive.