Typically, I invest in businesses with a 5 years horizon, but sometimes I’d like to allocate a small part of my portfolio for what I call “special situations”. These are ideas that I think have potential for high returns short- term. To be very frank, this is a way to simply scratch my itch by researching something completely new to expand my circle of competence, and at the same time have the potential to be rewarded quickly, yet keeping the rest of my portfolio intact. Anyway, I think GRSV seems like a great potential target. (h/t @contralculator for bringing my attention to this). As with my other ideas, all feedback is appreciated, especially if you have some opinions and ideas on areas do let me know where I might have overlooked!

The opportunity

So here’s the deal: the recent boom and bust on SPACs have seen them lose popularity with the markets, and the overreaction may have resulted in GRSV being thrown out with the bathwater, so to speak, and therein lies an attractive opportunity to rescue the baby.

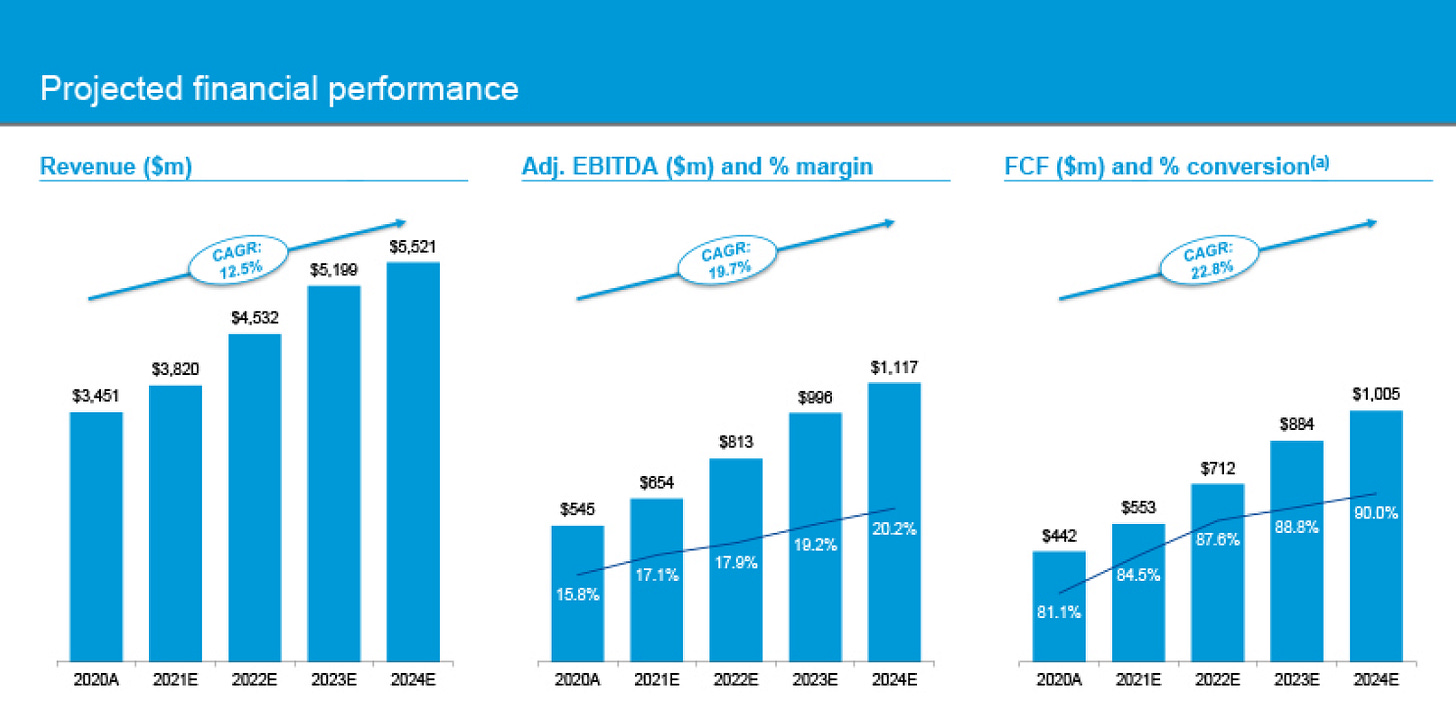

The way I see it, GRSV is a fairly good asset with a visible path for the stock price to be at $18 or more by 2026, driven primarily by capacity expansion, margin improvement, and FCF. The company should be able to hit guidance as revenue is mostly contracted, hence stable.

As such, the warrants are looking cheap. There is a chance GRSV would see a despac pop and revaluation when they merge and finally become their own, so that is a catalyst we can look forward to over the next few weeks.

Thesis highlights

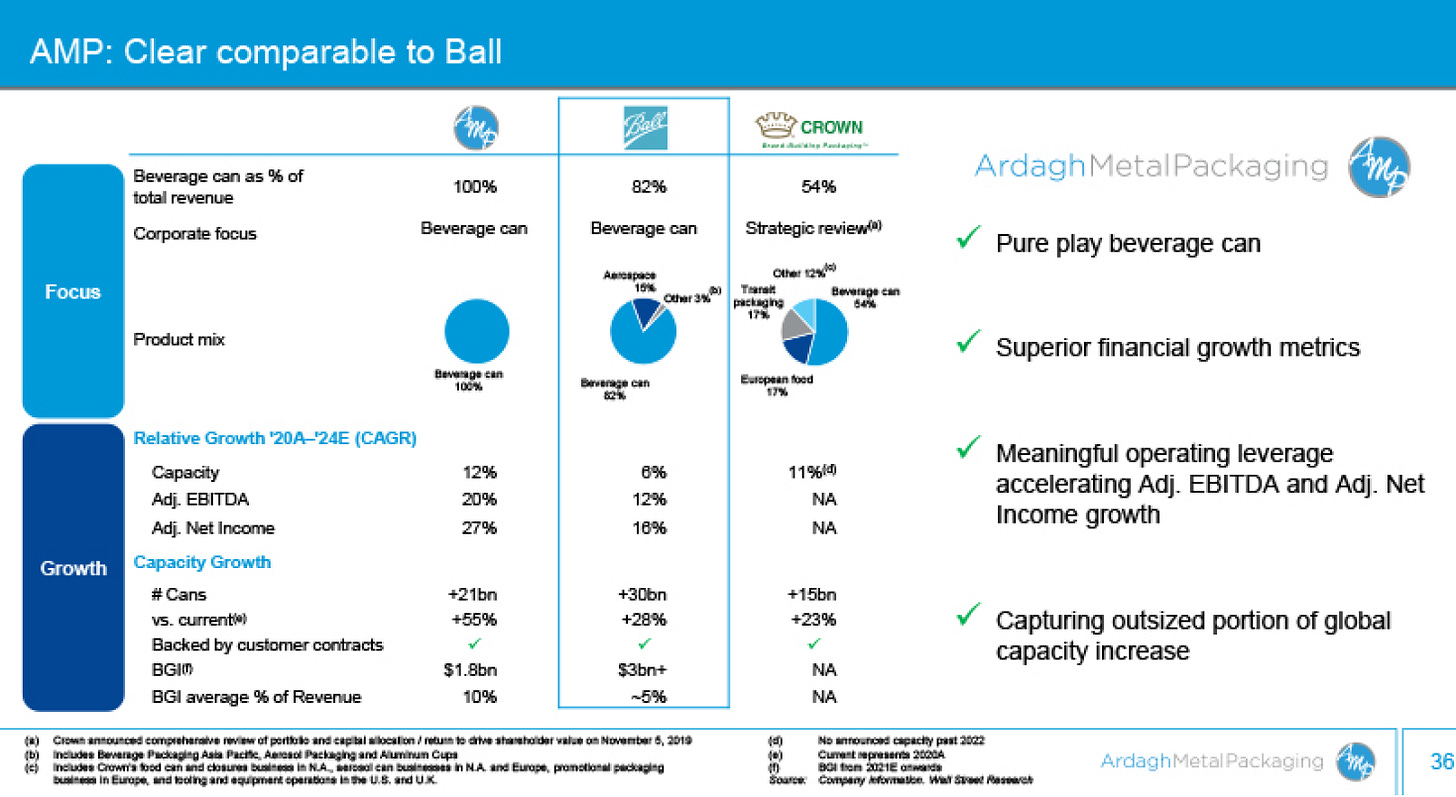

EBITDA to double on capital expansion — AMP has dedicated 1.8bn over the next 4 years to expand capacity by 55% to meet the contracted demand (over 95% contracted). This should double EBITDA. Based on commentaries and articles about the industry, it seems like that industry has reached an inflection point where demand exceeds supply, and demand is expected to outpace supply as the world shifts towards sustainable packaging

Margin expansion — management has guided EBITDA margins to expand by 400bps from 16% to 20%. This is possible given AMP’s cost structure mix of 75% variable and 25% fixed (25% contribution margin). BLL - the largest player - has also demonstrated margin expansion as it scales as well

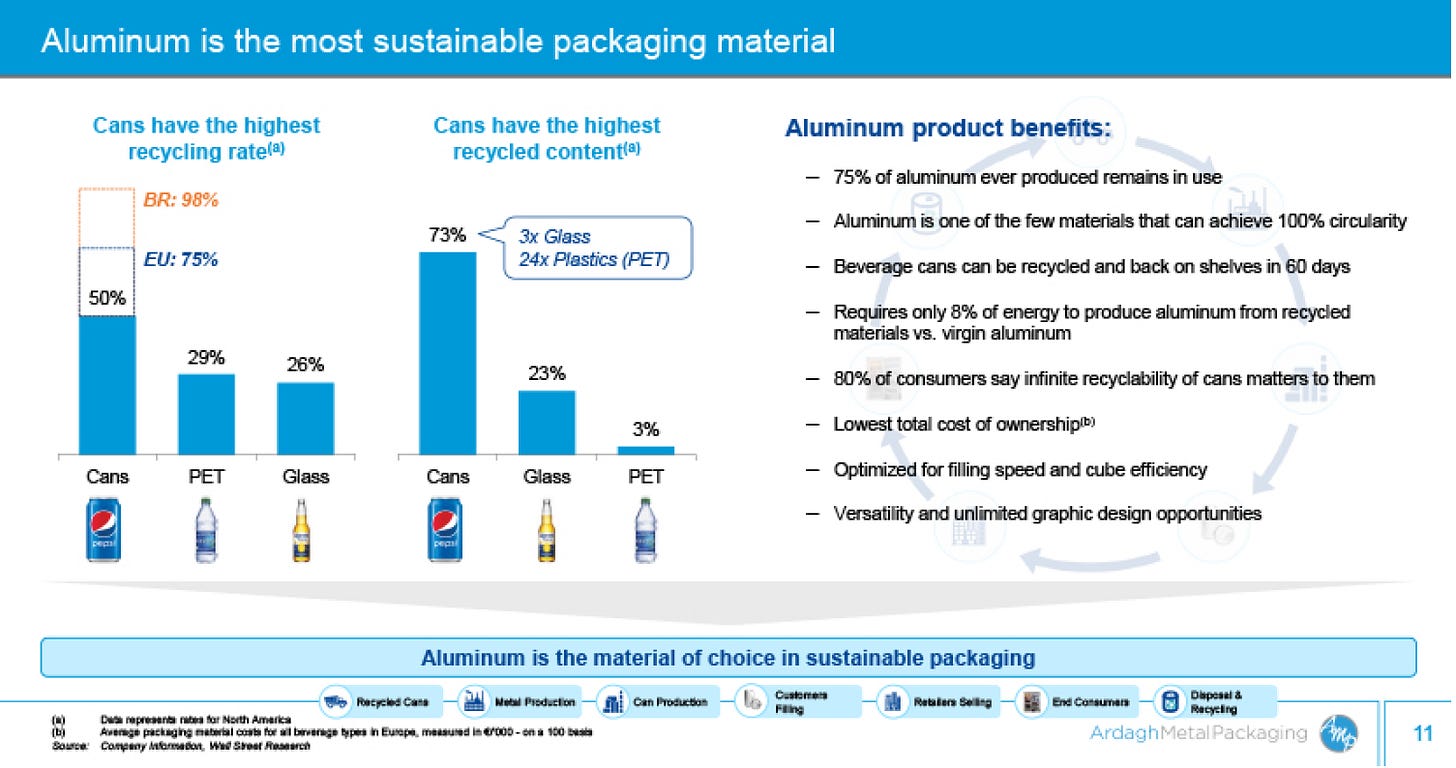

Secular trend — there is a demand shift from glass and plastic to aluminum packaging as aluminum packaging has the lowest total cost of ownership, highest recycled content, fastest recycling rate, etc.). AMP being the pure play aluminum can player will benefit most from this

History of the underlying company in question:

AMP used to be part of Ball Corportation (NYSE:BLL), but was forced by the Federal Trade Commission (FTC) to divest as part of a condition of acquiring Rexam in 2016 (link). The aim of this action was to prevent a monopoly from happening for the good of the customers of aluminium beverage cans, and encourage competition in this industry, as the acquisition of Rexam would have resulted in BLL having 60-70% of the GLOBAL supply of aluminum cans. The sale of AMP attracted many large interested investors such as Apollo, Blackstone, Madison DearBorn, but Ardagh Group (“ADG”) - a company that supplies glass and metal packaging products - emerged as the winner to acquire AMP for $3bn (8x pre-synergies EBITDA). (link)

Fast forwarding to 23 Feb 2021, ADG announced the proposed merger of AMP with Gores Holdings V (GRSV) and the intention to list AMP via the SPAC deal. This can be akin to ADG realising some gains by spinning off AMP through a SPAC deal, as ADG will retain 80% control of AMP.

Gores (GRSV)

The guys at GRSV are not new to the SPAC game. They have closed 5 deals so far and 2 upcoming ones (AMP and Matterport). They have been proven to be pretty good sponsors, given their past deals have generally worked. (GHVI is also pretty interesting .

AMP

The business is simple. AMP makes aluminum cans, and is the only pure play company that focuses on aluminum cans. Their main focus are on specialty cans that brings in more margin relative to the traditional cans. Majority of their sales are from Europe and North America, with 10% coming from Brazil.

Digging deeper into their revenue, more than 95% of AMP’s revenues are contracted to long-term contracts, which give AMP high visibility to their future cash flow. To make things sweeter, the management also mentioned that there are already contracts in place (>5 years commitment) to absorb the upcoming increase in capacity, which gives us more visibility to EBITDA growth.

It is unlikely that these contracts from large Consumer Packaged Goods (CPG) companies would stop contracting with AMP:

CPGs do not want to be dependent on a single supplier; hence purchases will be spread across the top 3 players to reduce reliance but ensure deliverability (AMP is one of the top 3)

Majority of the supplies from the large players have already been contracted, and these CPGs with large requirements will not actively burden themselves with operational complexity by engaging multiple small players. This situation is also exacerbated with the current supply/demand situation in the industry

It does seem like AMP has put themselves in a position of ensuring their earnings over the next couple of years if nothing changes.

The industry

AMP competes in an industry that is in a rational oligopoly, with the top 3 players occupying >80% market share (AMP is #3). The other two players are BLL (largest player with 40-45% market share) and Crown Holdings (CCK with 20-30% sales from aluminum cans).

This is an industry where scale matters, and so I do not really see a path for there to be many competitors appearing, at least within the next 5 years. So long as existing vendors continue to offer attractive prices to customers, there is no reason for customers to take a gamble on an unproven player. I’m sure there will be small players entering the space every now and then, but the effect will be minimal.

AMP is also in a sweet spot of riding recent secular trends, where more emphasis has been placed on environmental concerns and sustainable packaging. Aluminum, which AMP makes, is the most sustainable packaging material, with the lowest total cost of ownership, highest recycling rate, lowest energy requirement to recycle, to name a few.

There are also some good data points that management has shown in the deck that support this secular trend as well:

Some of the major brands have pledged to shift towards 100% recyclable packaging by the end of this decade, which supports the notion of sustainable packaging

There were also an increasing proportion of new product launches that were in cans (31% in 2014 to 75% in 2020)

The combination of the above points has driven the industry to an inflection point -- where there is insufficient supply to meet growing demand.

This demand outstripping supply situation is further supported by mentions from industry players and recent articles. Do note that this is despite them adding 66bn(!) more cans (30% increase over the next 3 to 4 years)

“Demand for aluminum beverage cans continues to outstrip supply around the globe, despite Ball exiting 2020 with 7 billion units of additional installed capacity.”

Daniel William Fisher, Ball Corporation - President & Director, 1Q21 earnings

“We expect demand (North America) will continue to outweigh supply for the foreseeable future and have several projects underway to increase production capacity.”

Timothy J. Donahue, Crown Holdings, Inc. - President, CEO & Director, 3Q20 earnings

“Literally overnight CMI members were working at full capacity to make much needed containers for food, personal disinfectants and beverages”

2019-2020 Annual Report & Can Shipments Report Page 27

“Can-makers are already having difficulty filling increased demand driven by more at-home consumption and the desire for more sustainable beverage packaging”

Aluminum demand from beverage, auto expected to grow: panel

If the trend is true and persists, then, AMP is in a great position to benefit from this.

Guidance

Management is currently guiding to $5.5bn revenue and $1.1bn EBITDA (20% margin) in 2024. I think there are a few things we need to believe for AMP to hit these numbers.

For revenue

Secular Trend to Sustainability Packaging is True — supported by industry players' commentary

Successful Execution In Expansion -- not an issue as there are no drastic differences in the upcoming plans vs. existing manufacturing plants. Besides, management has been operating in this industry for years already

For margin

Scale leads to margin expansion — Scale matters in this business due to invested fixed cost. AMP has a fixed/variable cost ratio of 25%/75%, translating to 25% contribution margin per incremental dollar of sales. It is plausible for margin to expand another 400bps. We have seen this happen at BLL, margins expanded as it scaled.

Warrants

To benefit from the asymmetrical risk/reward situation, I believe warrants (priced at $1.91 and expires in 2025 with $11.50 strike) will allow us to benefit most from the implied leverage.

If AMP manages to execute as guided, and trades at 14x (similar range to BLL), the stock is worth around $21, and management would trigger the redemption clause and buy us out at $6.60.

How do we lose?

Here are the possible scenarios to us losing:

Deal does not happen — GRSV/AMP deal is expected to close soon in July. We may be buying a piece of paper that is not worth anything. But that’s probably why there might be a despac pop. Given the current share price and the deal structure, there is a high chance the deal will goes through

Lower than expected demand — impair margins and profitability

Delay in building out capacity — Depending on the duration, this would impact AMP ability to expand margin as it cannot scale as fast as it needed for the stock to work

Comps

Conclusion

As always, please contact me if you think I am missing something. This is outside my circle of competence and so could easily miss something.

Other special situation posts

Well one and I agree. Maybe that's why I say 'well done.' It's simple, the parts fit and the growth is pretty much locked in.

hey, thank you for your subtack! it is really interesting. Can you write more about Takeaway.com pls? I'm also a shareholder (the reason i found your blog) and are interested in your opinion. A lot is happening with the fast delivery and Jitse is fallowing instead of leading the industry. And what is your opinion on the potential sell of the ifood stake? I prefer to hold it for the longer term but maybe they need the money to buy shares back to prevent a hostile takeover bid...

And further: What are your opinions on Prosus and Delivery Hero?