Olo part 1 - History of food delivery

It’s April and it’s time for a new series. This series covers Olo and why we believe it’s a valuable business that is worth keeping an eye on. We would also like to get feedback from fellow investors on our thought process so here goes.

*This post was done in collaboration with Ryan from Investing City (https://www.investingcity.org/). I highly recommend his service and is really something that can help investors quickly get to speed on new companies and industries! Thank you again Ryan!

“And the question is going to be how many of those restaurants have direct relationships versus marketplace relationships, which is, in my opinion, the greatest existential risks facing our industry, reminiscent of both the retail Nike versus Amazon, Disney versus Netflix, Four Seasons versus Expedia” - CEO Sweetgreen

Before we jump into Olo, it might be useful to have some context on the digital food economy - specifically, how consumers interact with and order from restaurants. Delivery is an integral part of the digital food economy, and without it everything is sort of meaningless. This is why it’s important to understand the food delivery industry first.

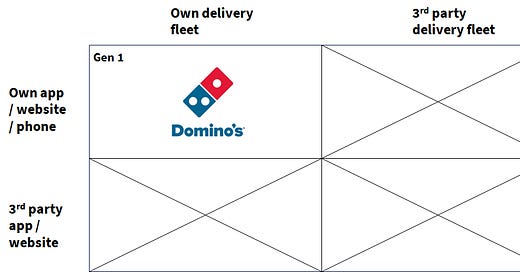

From the way we see it, there are three distinct types of restaurants, and a fourth rising. We denote each of these types as a “Generation”. Note that we are not using this to pass a value judgement. A Gen 1 operator is in no way worse than a Generation 2 operator. These labels are purely used to distinguish the way restaurants acquire, interact with, and deliver to their customers. Also, understand that there are two faces to the coin: there is both a Gen 2 operator and a Gen 2 platform. Also, a Gen 2 operator can also be a Gen 1 operator if the restaurant generates a substantial amount of demand from its own website or phone.

Generations

Generation 1: Dominos

Gen 1 restaurants are restaurants that own their own demand pool (app, website, phone) and couriers. Domino’s is the best example of a Gen 1 operator: they acquire customers through their own channels - their website or app - and then use their couriers to deliver the dough.

Restaurants that receive orders directly through the phone or their own websites can also be considered Gen 1 operators. Such restaurants are often optimised for delivery and receive tons of demand during peak hours, thus enabling them to batch orders. These are what we call marketplace restaurants.

Going off on a slight tangent here, lots of people have asked us why marketplace restaurants do not use logistics platforms for fulfilment. Isn’t it cheaper and operationally simpler? The answer is... it depends, but generally no. For most marketplace restaurants, it actually is cheaper and easier to use your own couriers if you have high delivery demand. Some of these marketplace restaurants generate 30 delivery orders an hour, making it easy for them to batch orders. How much trouble is it for a courier to wait 5 to 10 minutes to have 4 orders ready to deliver in a single run? Not much trouble at all. The average logistics restaurant might only receive 2 or 3 orders an hour, which makes it hard to batch without compromising on quality. Furthermore, these to-go orders often compete with the more profitable dine-in orders for capacity for the average restaurant, but not for the delivery-one restaurant. Food for thought: why doesn’t Domino’s use 3rd party delivery services for delivery?

Generation 2: Just Eat and Takeaway

On to Gen 2 - marketplace platforms and their dependent restaurants (internet marketplace restaurants). With the advent of the internet, it became infinitely easier to build a central database of marketplace restaurants. Platforms like Grubhub and Just Eat rushed in to consolidate and put restaurant menus online, greasing the wheels for consumers to order from them.

This resulted in Gen 2 restaurants that get their demand from a 3rd party platform like Grubhub, but use their own couriers for fulfillment. Like Gen 1 operators, most of these Gen 2 restaurants used to derive most of their demand from offline sources, but in this day and age, more and more of their orders are now coming from online.

You won’t see restaurants like Nando’s or Wagamama here since these restaurants do not have their own delivery fleet.

Generation 3: Deliveroo, Doordash, and Just Eat Takeaway

Gen 3 food delivery platforms were born from the rise of the smartphones and reliable GPS. To us, this was pioneered by Deliveroo’s Will Shu, who discerned the market gap for higher end restaurants.

He noticed that rich London city boys were happy to fork out a premium for quality food delivered from Nando’s and expensive steakhouses. But these restaurants did not have their own couriers as their demand for delivery was far too low hence the inability to order from them to begin with. Their demand was low as they served a relatively small market segment, and only for a few hours a day. What’s more, these foods typically did not travel well.

In light of this, Will created an app that featured these high-end restaurants, and used Deliveroo’s couriers for delivery. Individually, these restaurants did not have sufficient demand to justify hiring a courier, but as they say: there is strength in numbers. In this case, the unit cost of a courier could be lowered by pooling demand. Rich kids get their steaks, incremental profits for the restaurants, and everyone wins!

Gen 3 platforms, with their attendant delivery fleet, cater to restaurants that do not have their own couriers. In the same way, Gen 3 platforms did not have good product-market fit with Gen 1 and 2 restaurants, as those restaurants generated sizable delivery demand and could batch orders making owning couriers worthwhile (Domino’s).

This new business model quickly proliferated across the globe. Uber Eats and Doordash in the US. Skipthedishes in Canada. Meituan in China.

Over time, this gave rise to what we call the Gen 3-B platforms. These are the hybrid platforms like Just Eat Takeaway. These platforms have the marketplace restaurants that do their own delivery, and non-marketplace restaurants that use Just Eat Takeaway’s couriers. This allows consumers to access a wider selection of restaurants, resulting in even stronger network effect in regions with lots of marketplace restaurants.

Generation 4

The Risk

[This is where we will spend most of our time given its relevance to Olo]

As delivery became more prevalent (accelerated by Covid), chain restaurants that did not own their delivery network started to worry about disintermediation. The possibility that they were going to get “Amazon-ed” over time and forced to surrender an increasing piece of their profit to the platforms was real.

“And the question is going to be how many of those restaurants have direct relationships versus marketplace relationships, which is, in my opinion, the greatest existential risks facing our industry, reminiscent of both the retail Nike versus Amazon, Disney versus Netflix, Four Seasons versus Expedia” - CEO Sweetgreen

Food delivery platforms like Deliveroo and Doordash started launching dark kitchens, and sold ad space that effectively allowed other restaurants to buy up their online real estate (a local chicken shop can buy ad spaces and show up as the first result when customers typed “Nandos” on Deliveroo).

On the latter point, imagine a consumer who wants to buy a pair of Allbirds and searches “Allbirds'' on Amazon. The first thing that pops up is “Le Moutou'' a sponsored product that not only looks exactly like Allbirds, but is much cheaper to boot. Would you get it? Many, too many, would. In a way, not owning the distribution channel (i.e. being on a third-party food delivery platform) can generate negative demand as hungry customers that would have otherwise bought from the brand’s restaurant get siphoned off, lowering marketing efficiency and weakening its control over its economic destiny. This might not be commonplace today, but it will come as delivery platforms increasingly become the top-of-mind destination for customer food orders.

The Benefits

There are also MANY benefits for a restaurant to own its own app. This includes being able to send highly personalised and targeted ads or promos to customers to drive demand, and embedding a loyalty program to drive frequency/retention. Think Starbucks.

In order to better position themselves, some of the more forward-thinking restaurants have already begun to embrace white label delivery. These are restaurants that generate demand through their own app and website but use a 3rd party delivery service for fulfillment. These are what we call the Gen 4 operators.

These are restaurants like Nando’s, Chipotle, Shake Shack, and Burger King that incentivise customers to download and order from their app through cheaper menu prices, delivery fees, loyalty programs, and unique products on their app. However, they continue to offload the delivery to logistics providers like Deliveroo, Doordash, and Uber, allowing these Gen 4 operators to maintain their direct consumer relationship while benefiting from the logistics cost efficiencies of the Gen 3 logistics platforms. Vendors like Chipotle already drive 50% of their delivery demand organically through their app and that mix is growing as Chipotle continues to give consumers more reasons to use their app and customers churn from the 3P platform to its app over time.

While not a delivery vendor, Starbucks is a great example of an efficient Gen 4 operator. It generates almost all of its demand through its own app and retains customers via an attractive loyalty program. Once Starbucks embeds white label delivery onto its platform, you can expect it to generate virtually 100% of their delivery demand through their own app.

We bet you are thinking: well people don’t want to use multiple apps! To that, we say, look at how many apps you have downloaded onto your phone? Also, 80% of your orders probably come from a very small number of restaurants. If you are ordering every other week from these restaurants, be it delivery or pickup, will you not use the app if you can get free food, promos, and collect loyalty points?

The Problem

We’ll take our rose-tinted glasses off now - being a Gen 4 operator comes with its own challenges. As these restaurants lean into digital, of which delivery is a critical element, operation becomes more complicated. Many of these restaurants operate with a disparate set of solutions from their point of sale systems, payment processing system, kitchen display systems, loyalty programs, reservation system, employee management system, and delivery vendors. Operations are extremely stressful as these restaurants have to attract consumers to their outlets, and then get through them efficiently to make a profit in their high fixed cost competitive industry. Operators must then rely on a battalion of high-churn staff (most part-time) that often do not have the time to learn the intricacies of the different products whilst handling the horde of very emotional customers that often arrive at the same time.

And now we got to layer in digital? Workers must now manage their own POS and multiple tablets from all the delivery platforms. What if Burger King runs out of their Hershey Chocolate Pie or god forbid...pickles? That restaurant must then update the menu across its POS and all the tablets to prevent customers from ordering that item. What if you have a line of 20 people waiting to order and then get like 100 delivery orders? It is easy to turn away dine-in customers or control the demand of dine-in customers via a line. But if you so fortuitously receive 100 delivery orders... what would you do now? The way food delivery and digital orders are managed in the past no longer works at scale and a new way of operation is necessary.

Enter Olo

In the next post (perhaps next week, perhaps later...we will see), we’ll discuss how Olo helps restaurants straddle the on-premise and digital world, and allows restaurants to re-capture and better monetize their customer relationship. We’ll also talk about how this might fundamentally change the way restaurants operate, turning them from a demand taker to a demand maker.

We might also talk about how Olo is positioned relative to its competitors and what allows it to defend its market position. And how Olo might be a major threat to long term earnings potential of the food delivery platforms in the US and Canada. Lastly, We will talk about the financials, valuation, and our expectations.

For readers interested in $TKWY and $ROO, don’t fret as more will come.

Links to other parts: