Olo part 2 - Value proposition

*This post was done in collaboration with Ryan from Investing City (https://www.investingcity.org/). I highly recommend his service and is really something that can help investors quickly get to speed on new companies and industries! Thank you again Ryan!

TLDR: let’s be honest, people working in restaurants are not the most motivated sort, and if you make life complicated and challenging for them, your business is going to suffer. This is why the best restaurants assets are QSRs and why fine dining or full services restaurants go out of business all the time. The way digital ordering (pick up and delivery) is being done now is super inefficient which ultimately has an impact on the financials or customer experience. Olo is the only one (to my knowledge) that is able help restaurants straddle both the on-premise and digital world in an efficient manner and should be compensated well for it. Olo also allows restaurants to control the customer relationship and fight back against the aggregators, which is an increasingly important value proposition.

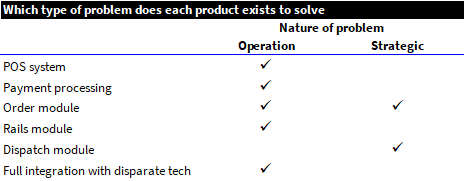

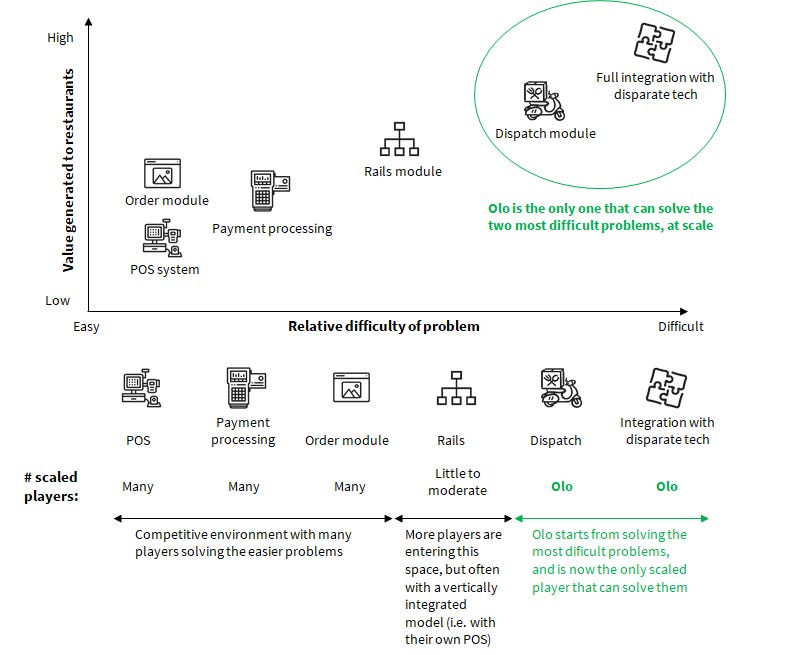

Businesses exist to solve problems. Generally, the level of monetisation and the defensibility of that monetisation depends on the difficulty of solving those problems and whether there is a path to replicating that business. This is why we generally do not like businesses that compete with their ecosystem (i.e., those whose incentives do not align with their suppliers/users), instead preferring those that enrich it. Olo belongs to the latter.

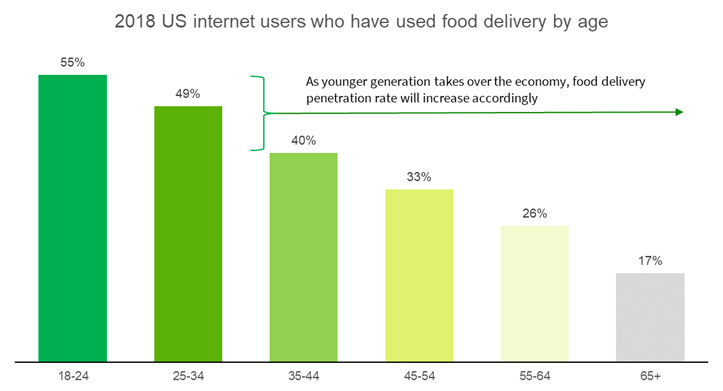

Food delivery is, in all likelihood, going to be a massive part of the economy two decades from now as the masses become more comfortable with both delivery, and engaging digitally with restaurants. But apart from savvy vendors like Chipotle and Sweetgreen or delivery-focused player like Dominos, many chains do not yet have the digital capabilities to navigate this new world.

This was in 2018. The proportion of customers in each cohort that have used a food delivery app has likely increased now, in light of the pandemic.

Olo helps these restaurants operate in this digital world, firstly by reducing operational complexity, and secondly by allowing them to build and control direct consumer relationships.

Olo does this with 4 products - 3 explicit and 1 implicit.

The company has 3 explicit products:

Order: helps restaurants build a straightforward customer-facing interface that is consistent and easy to manage

Rails: helps restaurants solve the problem of “tablet hell”, “tablet management”, “menu management” and “order modulation” by integrating and controlling orders from 3rd party apps

Dispatch: enables restaurants to tap into a pool of on-demand logistics providers

Each of these products are valuable, but the Dispatch business piques the most interest and is the one that (in our opinion) drives the most value. It also happens to be the one that is least recognised in the current financial statement.

Order

Rather than telling you, let us show you how Order works:

The problem: restaurants do not have a centralised database to manage orders from multiple channels. There are simply too many channels where orders are coming from (website, kiosks, phone, dine-in, aggregator tablets, etc.). There are also instances where restaurants have to manage multiple handoff methods (delivery, in-restaurant pickup, curbside pickup, etc.), this adds another layer of complexity to restaurants’ order management.

To address these issues, restaurants have adopted a motley of technology providers to address each individual issue, leading to disparities in the technologies used across a brand, or even within a given location. As with any set of disparate solutions, they do not integrate seamlessly with each other. Restaurants run the risk of:

Bad customer experience - failure to fulfil demand as orders did not flow to POS system

Operation deficiency - unable to process customers order within the promised timeframe, triggering a cascading effect on subsequent orders

In addition, restaurants menus are inherently complex, highly configurable, and frequently updated for all sorts of reasons such as:

Different promotions, menu options or prices for different regions

Taking out a particular menu item due to lack of ingredients (which has to be done instantly to prevent customers from ordering it)

To top this all off, there is an increasing need for restaurants to offer intuitive digital menus for picky eaters to customise their orders (i.e., add sauces, remove pickles, double the spiciness, etc.). For instance, with Subway’s >20,000 outlets in the US, can you imagine the operational nightmare it will be to update the menu for each outlet via different databases.

These issues have a huge knock-on impact on restaurant’s back-end systems - trust me, I (newmooncap) have had my fair share of such problems while helping to manage my firm’s portfolio of restaurants. The inability to capture orders accurately will impact the Procurement’s team ability to track inventories, the Finance team’s ability to manage cost/budget, the HR team’s ability to manage manpower during peak hours, and the Marketing team’s ability to track customer spending. (These are but some examples - in reality, there are many more).

As a chain expands, these operation gaps will snowball over time and open a Pandora’s box of financial and operational nightmares.

Olo’s solution: The Order module solves all these issues. It offers restaurants a fully-integrated solution that enables them to manage orders, payment and menu from a single database. The Order module captures orders from all channels and transmits the data to the POS system and KDS simultaneously. This allows restaurant staff to ensure fulfilment and provide accurate estimates of when the food will be ready.

Olo’s Order module ensures good customer experience (orders are fulfilled), and improves operational efficiency (reduces frequency of orders jumping queue). Since all data originates from a single database, restaurants can now synchronize and manage menus efficiently from a single dashboard (a single operation staff can now manage the workload of an entire team previously).

Revenue model: Olo charges restaurants a fixed subscription fee/month to access the Order module. There are multiple subscription packages (link) that restaurants can select from, each tier entitles the restaurant to x number of orders/month (packages range from 100 orders/month to 3,000 orders/month). Restaurants will be charged a small fee/order for each order over the chosen package limit.

Rails

Product overview:

The problem: Have you ever experienced “tablets hell” in a restaurant? The cashier is repeatedly punching orders into the POS system while the tablets constantly pings to herald in a new order. Worse still, such moments tend to occur during peak dine-in hours, exacerbating operation inefficiencies. The growing adoption of food delivery platforms have put several restaurants to the test, with many restaurants ill-equipped to balance this on-premise and off-premise dynamic. What do we get in the end? Well, usually a bad customer experience due to long wait time, poor food quality as orders were rushed, missing items etc.

There is also another layer of complexity in managing the menu listed on 3rd party food delivery platforms. Restaurants have to update each of these menus individually every time there is a change in promotion, pricing, and menu items. “Bummer, I forget to remove the promotion on Deliveroo, we’ve now sold a ton of $1 happy-hour burgers for dinner”

Olo’s solution: The Rails module solves all these issues. Firstly, it eliminates the need for standalone order management tablets by integrating orders from platforms into restaurants’ POS systems directly. Secondly, it enables restaurants to monitor and parallel process orders across various channels to more accurately prioritize and fulfil orders. The Rails module also optimizes yield during peak hours by prioritizing different ordering channels, with the highest priority items fulfilled first to maximise profitability. Lastly, with Rails, restaurants can manage menus on 3rd party platforms from a single dashboard. Any updates to the menu (e.g., pricing, availability, promotions, etc.) will automatically synchronise across the platforms. Taking digitalisation a step further, Rails also allows restaurants to fulfil orders from non-market place digital channels (e.g., Google Food ordering), a good-to-have though not a game changing offering.

Revenue model: Olo only charges aggregators (i.e., $DASH), and other service providers in the ecosystem, on a per order basis (recognised as transaction revenue in P&L). As for non-market aggregators (e.g., Google Food Ordering), Olo generates fees predominantly through revenue-sharing agreements. As for restaurants, they are not charged for rails on a standalone basis, instead, rails orders are considered part of the subscribed package under the Order subscription package (link).

It is tough to estimate how much exactly Olo is charging per transaction, but our best guess from a bottoms-up build suggests a fee running between 5c to 10c.

Dispatch

Product overview:

The problem: There are multiple considerations in the logistics of food delivery:

Does the restaurant have enough couriers?

When will the courier arrive for collection?

How long will the couriers take to deliver and how much does it cost?

How do restaurants tag each incoming order to its handoff methods?

How do restaurants manage all the DSPs that they are working with?

And since food delivery is an on-demand purchase, it further increases the complexity in managing it. These are questions that restaurants are consistently worrying about with food delivery, particularly when consumers tend to pin the blame on the restaurants if they are dissatisfied with the delivery.

Restaurants must adapt to better accommodate delivery orders, as proven during COVID period where there was a massive increase in delivery orders. Restaurants need a solution to manage multiple DSPs to ensure consumers get their food reliably at cost-effective prices.

Olo’s solution: The Dispatch module solves all these worries:

Do the restaurants have enough couriers? - Dispatch integrates with a nationwide network of 3rd party DSPs.

How long will the couriers take to deliver and how much does it cost? - Dispatch enables restaurants to automatically select the optimal DSP based on a pre-selected preferred set of attributes (delivery time, cost of delivery, order size, etc.) for every single order at each individual location. This ensures restaurants are able to set customers expectation right on delivery time, and offer delivery at a competitive cost

How do restaurants tag each incoming order to its handoff methods? - Dispatch has full integration with restaurants’ POS. Every order will be tagged automatically to inform on choice of DSP

How do restaurants manage all the DSPs that they are working with? - Dispatch module integrates all participating DSPs which are operationalized together on a single software platform / dashboard that restaurants can manage altogether

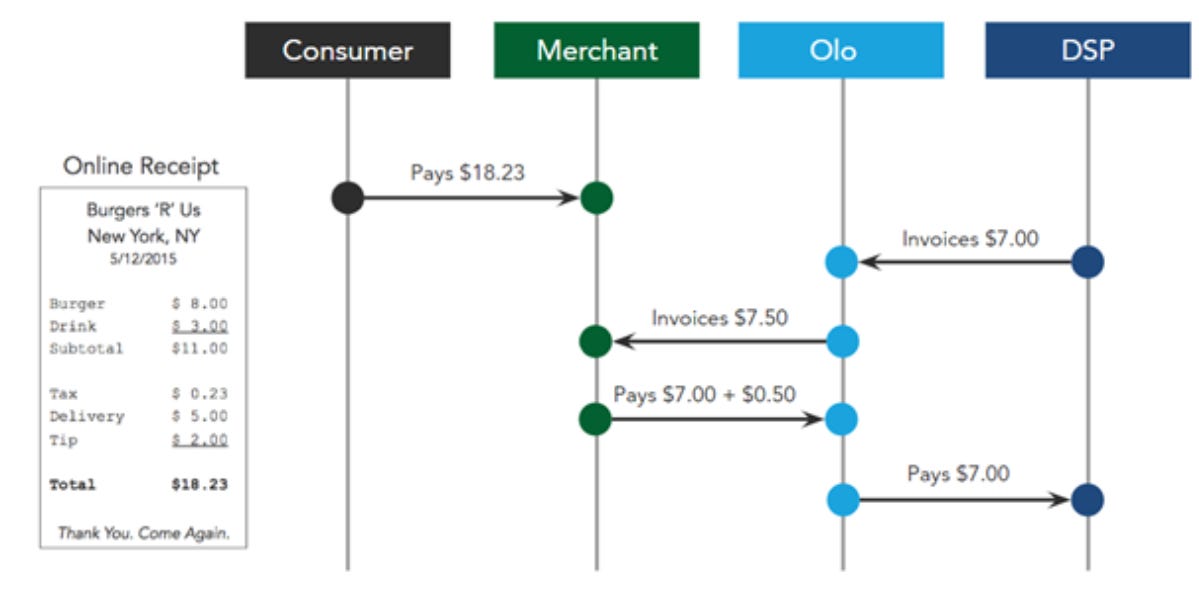

Revenue model: Olo charges restaurants (link), aggregators (Dash agreement) and other channel partners on a per transaction basis. There are two revenue streams here:

From the restaurants (range between 25c to 50c, based on transcripts and Olo’s illustration below)

From the DSPs (we don’t really know the answer to this yet, but if we have to guess, it would be a lot lower than what the range restaurants pay, since the DSPs are the one actually fulfilling the orders)

The product: Every regional vendor (e.g., Waiter in Louisiana or Delivery Dude in Florida) can now participate and capture a piece of the pie; we can expect a proliferation of local on demand vendors to appear, making Olo a network of logistics providers. Whatever courier liquidity pool that Doordash or Uber has no longer matters as restaurants can tap on the courier pool of the entire market. As with all commodity products, it boils down to price. Whichever vendor that can offer a cheaper cost per order will be heavily favoured by the restaurants (cost is afterall the biggest hurdle to consumers ordering).

Dispatch also lowers the hurdle to spawn dark kitchens, it allows dark kitchens to quickly tap onto a nationwide pool of on-demand courier fleet to maximise demand (able to generate demand from all platforms), at competitive cost and service level. A good example is MrBeast. MrBeast launched 300 dark kitchens nationwide without the need to worry about logistics, all it did was to adopt Dispatch, and that’s it.

Dark kitchen is like any other restaurant, a high fixed cost business. Operators need to get as much demand exposure as possible, and be able to fulfil those demands to reap the benefit of operating leverage (or even to stay profitable).

On a side note, if operators need to maximise demand exposure, then why would any operator limit themselves to a fraction of the market? Yes, pointing at our friend $ROO’s vertically integrated dark kitchen (Edition) - $ROO’s Edition only has exposure to 20% of the UK market. It is unclear to me how will Edition ever be profitable.

The “fourth” product — Integration

This is, in our opinion, the most important product that only Olo is able to offer — integrating the restaurant’s entire tech stack. This problem is arguably the hardest problem to solve.

The enterprise restaurants in the US are heavily dominated by quick service chain restaurants (think Mcdonalds, Subway, KFC, etc.), and these restaurants typically operate on a Brand —> Master Franchisor —> Franchisee business model. The combination of this model resulted in franchisees adopting a disparate set of technology solutions. To top it off, many of these franchisees are operating using legacy systems that are not built to integrate well with other solutions (i.e., legacy POS systems).

It becomes a nightmare when operators and backend functions need to review certain operating data.

Employees have to pour in several man hours to do number crunching on spreadsheets

Data are often not accurate due to human error and technology disability to capture certain data

The lack of data fidelity also weakens operators ability to better position the restaurant for the digital world. The best CRM solution in the world would not work if there is no data to work with.

Olo has built its product with the focus of solving this problem. As such all the above mentioned solutions are integrated seamlessly into existing restaurant infrastructure. Olo effectively becomes the ERP system of the restaurants, where there will be a single source of data (all data flows through Olo).

Differentiation and competitive landscape

Clearly Olo generates a ton of value to the restaurants. But does Olo have a sustainable moat that allows it to capture a portion of the value add, or will competition drive its profit down and it is the restaurants that will capture all of the value?

When we think about what Olo does, it is clear that integrating with its restaurant partners is the most difficult thing. The integration process with its enterprise partners is very long (think the duration of deploying an ERP system) as Olo must work with a disparate set of solutions across different restaurants and jurisdictions. It is extremely challenging to manage digital orders with legacy solutions (as mentioned above), as such, most competitors attack this industry via a vertically integrated but low integration model, where they sell the restaurant a POS system that connects with all the delivery vendors, but does not work with legacy systems. Such competitors are most valuable to newer restaurants and smaller chains where the level of required integration is much lower than enterprise restaurants.

Cycling back to Dispatch (Olo’s weapon). It is unique in the industry and we believe would give the company a meaningful edge in customer acquisition. At the end of the day, leaning into digital also means owning the customer through your app and using white label delivery for fulfilment. If you are unable to offer white-label delivery to your partners, then what is the point? We believe Olo has recently won Hooters in the US from Ordermark because of its Dispatch module. As easy as it sounds to just partner with white-label vendors, it is actually hard to replicate Olo’s offering due to national scale. Olo has the ability to work with all the national and regional delivery vendors, making them the vendor of choice as they can offer the cheapest delivery with the best service level by having the deepest courier liquidity pool.

It will take a substantial amount of time and effort for competitors to replicate Olo’s Dispatch module, meanwhile Olo would have already onboarded many of the most important enterprise brands. Olo already has ~20% of US enterprise locations on its platform and is adding a ton more every year.

In our next post, we will touch on Olo’s competitive landscape and risks.

Links to other related parts:

Thanks, good read. Sounds like Olo solves a whole host of issues and have a very sticky product. I'm skeptical to what extent Olo helps restaurants regain control over the customer relationship though. Providing the infrastructure such as CRM and an app is helpful, but it's still up the restaurants to find a direct acquisition strategy (impossible?) or encouraging marketplace customers to place future orders directly with the restaurant (without getting kicked off the aggregators for probable breach of T&Cs).