We believe we’re winning in places like the U.K and Japan...and we are continuing to improve the economics

Dara’s latest comment has caused a stir (bullish sentiments) within the investment community (RE:Fintwit).

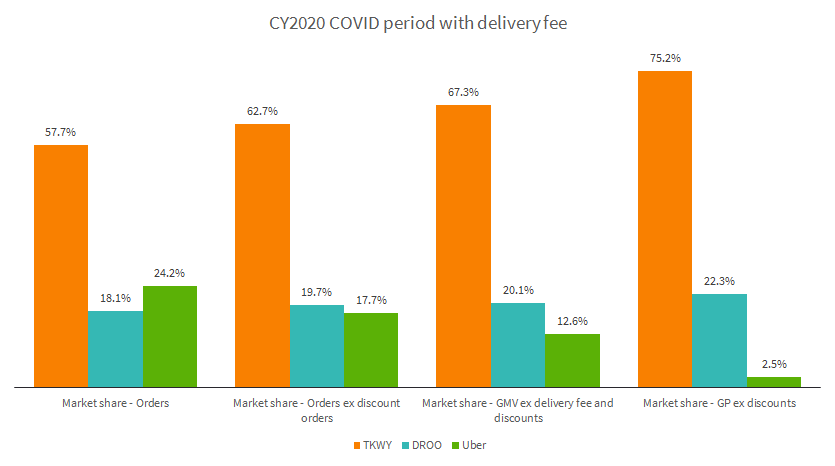

I’ve received messages asking why haven’t I talked about Uber Eats in the UK, and mainly focus on Deliveroo? Well, that is because I truly believe that $UBER is in a much weaker position than Deliveroo, despite having more market share (orders).

Investors seem to not understand that not all share is created equal. It is crucial that we differentiate the quality of share, and $UBER business consists mainly of notably low quality share.

$UBER generates the vast majority of its orders from a limited number of restaurants (mainly QSRs), that have inferior unit economics. This is an extremely low quality share, as competitors ($TKWY) can replicate that inventory effortlessly. On the flipside, it is significantly more challenging for $UBER to replicate $TKWY large inventory of marketplace restaurants (thousands of them).

Despite meaningful differences between a marketplace order and a QSR order, some investors appear to be conflating them, and are ascribing the same value to the two. To adjust for these meaningful differences, it is important for us to look at market share from different perspectives (by orders / GMV / gross profit basis).

Current share

At a glance, investors might say: “Look, Deliveroo and $UBER collectively managed to capture 42% of the market. By repeating the existing strategy, they should be able to capture more”. Issue is, investors ignore the profitability of these orders.

$UBER orders mix heavily to QSRs ($MCD) and players like $TKWY orders mix to marketplace, while Deliveroo orders mix to high-end restaurants. This means that $UBER AOV is significantly lower than peers (~£14 excluding delivery fee [£3], relative to £20 for $TKWY and Deliveroo). Simply viewing it from GMV (excluding delivery fee and discounted orders), we can see that $UBER market share is closer to 13% as opposed to 24%.

The lower AOV aggravates $UBER inferior unit economics situation. Lower AOV has a non-linear impact on profitability as the cost of fulfillment is fixed. Hence from a gross profit perspective, $UBER is near GP breakeven on its average order, while Deliveroo is still profitable.

All in all, we could easily see that $UBER market share is really a mirage of a willingness to incinerate cash and accept vastly unfavorable terms. ($UBER is burning tons of cash - through discounts - just to support current ~13% GMV share). Demand generated by discounts/promotions are one-time in nature, a low quality share. The reason is simple - once the vouchers stop coming, so does the demand.

Now, this is not to say that it is a bad strategy. The issue is bulls only rely on share of orders to make judgment about $UBER market share and business trajectory, without consideration of the quality of that share.

Normalized and future share

The above chart is based on 2020 AOV, which is elevated due COVID. Now imagine how bad it would look once we normalize AOV (after COVID passes). It would shatter $UBER unit economics, showing a worse picture.

A back of the napkin estimate easily suggests an additional 1 to 2 points being shaved off $UBER GMV share.

As to how things will play out between $TKWY and $UBER in the future. $TKWY probably doesn't even need to cut delivery fees to capture $UBER users, offering logistics is sufficient to cause a huge dent on $UBER GMV. Simply because users that previously couldn’t find what they want on $TKWY platform will no longer go to $UBER.

Think of it this way. $UBER order volume is a function of last year orders (churn + new orders). . Moving forward:

The amount of new orders are going to decline. Why? Because majority of new orders came because people couldn’t find Mcdonald’s and other chains on other apps, especially $TKWY since most people have it

Users churn is going to increases as they move to the $TKWY platform. Why? because $TKWY offers no delivery fee (financed by marketplace) and has greater restaurants selections (again due to marketplace)

Therefore, $UBER total orders will be negatively impacted as both growth drivers of order turn negative.

I’m glad there are actually people reading my stuff (honestly thought nobody cared), and have received interesting inputs. Also, thanks to those that sympathize with my student loans situation. I’m adding a donation button below. If you find value in my work, help out by buying me shares in $TKWY (or wine as I write these posts at night with several glasses of wine).

Links to other related parts:

Links to other related companies:

Great work. Would be good to be in contact. How do I DM you?