Reply from Jitse (TKWY CEO):

Why is Takeaway.com so hated?

Why is the stock price down after its 4Q20 earnings print?

Why are people so shocked by the company’s decision to take down profit to capture market share – didn’t the company inform investors that they would do just such a thing, and history (Germany) would suggest that is the right strategy?

In this post, I would delve into what I believe is the company’s strategy and why the company is poised to win in the long run. This deserves a post itself, rather than a twitter thread (I usually only post when I feel like the market really misunderstand a critical fulcrum issue on a company - see previous posts on SE and NFLX).

Debate

What’s Takeaway strategy? Somehow, Fintwit has this conception that Takeaway is eBay or legacy GRUB – unwilling to change with the times and maniacally focused on profits.

Part of this is the fact that Jitse (Takeaway.com founder and CEO) kept saying that “logistics food delivery is not profitable in Continental Europe”.

However, believing that logistics food delivery is not fundamentally profitable and investing in logistics are not mutually exclusive.

Jitse has repeatedly said that logistics is necessary to keep consumers on the app, as consumers can get all the restaurants that they want on a single app and hence much less likely to churn.

This logic is pretty straightforward:

It’s Friday Night and I would like to get a cheeky Nandos

However, there is a pandemic so I can’t go out to Nandos

So, I search Just Eat for Nandos

There is no Nandos on Just Eat

So I Google ”Nandos delivery” and found that Deliveroo would deliver Nandos

I download the Deliveroo app and order Nandos

In order for Just Eat to keep that customer from going to another app, it has to offer logistics (Nandos). It is a customer retention tool.

However, because it has value as a customer retention tool does not mean it is very profitable, if at all.

In fact, without a delivery fee, that order would be very unprofitable. It is only after implementing a $3 delivery fee that the business works (barely).

Okay…but if logistics is so unprofitable/unappealing, why is JET trying to push Deliveroo and Uber Eats out with a $0 delivery fee strategy?

The answer is simple: to prevent logistics player from building a large enough customer base to enter the marketplace business.

While it is true that logistics is not profitable (much) as a standalone, it can be used as a customer acquisition strategy to build a large enough customer base such that it is possible for logistics players to acquire marketplace restaurants, which are very profitable. JET is trying to eliminate this risk.

Strategy

The strategy seems really simple to me:

1. Run logistics at $0 delivery fee, forcing Deliveroo and Uber Eats to match or lose market share

2. Deliveroo and Uber Eats won’t be able to match the delivery fee and so would lose market share

3. After winning the market, raise delivery fee (Germany and Netherlands) or instill minimum AOV (maybe $30) to make the unit economics work

JET can do this as the average logistics customers acquired also order from the highly profitable marketplace restaurants. Here is how it works:

1. I want to eat Nandos

2. Google Nandos and find that it is offered on JET for $0 delivery fee

3. Download the Just Eat app and order Nandos, but notice that other restaurants are available

4. Order from other restaurants in the future (which are likely to be marketplace restaurants)

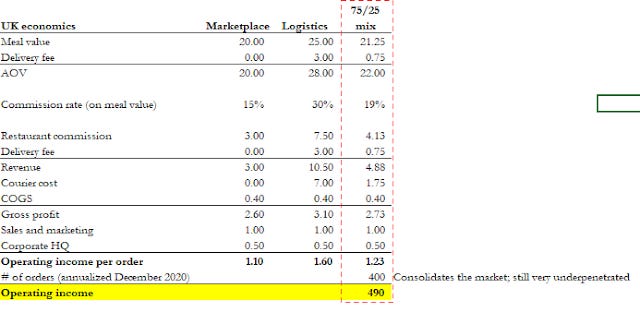

JET will still be profitable if 75% of orders are from marketplace, and 25% from logistics (assuming no delivery fee)

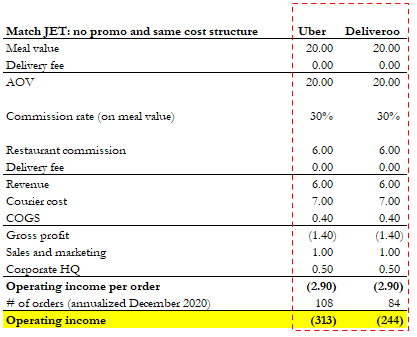

However, Uber and Deliveroo would lose 550mn pound per year cumulatively (~750mn USD) if they try to match.

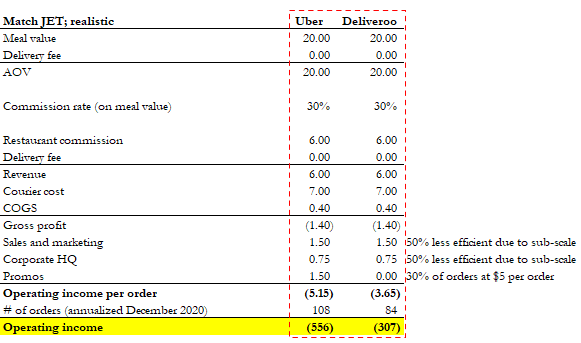

However, we must understand that Uber and Deliveroo are sub-scale relative to JET and so have inferior cost structure. Moreover, Uber has been giving a lot of promos to customers and those costs money. Using some reasonable assumptions, one might get to a total burn rate of ~GBP 860mn (nearly US$1.2bn) per year simply to match JET $0 delivery fee.

I do not think that sort of burn-rate is tenable especially as JET is able to operate at this unit economics indefinitely (as it is profitable). This is especially the case as we are simply talking about the UK. Imagine this situation occurring all across Europe (Spain, Italy, France) – the cumulative cash burn for the pair would be immense. Certainly, Deliveroo would not be able to finance this attrition war.

Moreover, JET has the extremely profitable Germany and Netherlands business which generates hundreds of million of EBITDA every year which can help in this “attrition war”, and a super valuable multi-billion $ stake in iFood which can (will) be monetized.

What if they match?

Someone might then say…well Uber has a lot of cash and a rideshare business which can be used to finance a food delivery war in the UK. Losing 2bn/year is no problem for Uber. The company has burnt MORE in the past!

That is true…but to what end? To defend a sub-scale market position where it has 20% market share (much of which were subsidized)? And a business that might break-even at best without a credible path to push out Just Eat?

And even if Uber decides to match, it is likely that it would still lose market share as it remains inferior on selection and coverage

So even if Uber and Deliveroo matches JET, they will still lose share because they are inferior in selection and coverage. What else can they do to defend their market position?

Here are some ideas (please reach out to me if you have any other ideas):

- Exclusivity contracts

Pro: prevent JET from getting those restaurants, and create differentiation

Con: very expensive – unit economics would be even worse.

What can JET do to counter: if anything, JET is in the better position to win exclusivity contracts as it has superior coverage (McD would prefer to be exclusive with JET as JET has the largest customer base and cover all of the UK – lots of benefits including efficient nationwide co-marketing)

- Bundled services

Pro: Uber can sell a subscription service bundling rideshare with food delivery and groceries à offer no delivery fee to customers with the pass, locking in users

Con: It does not actually make it cheaper because JET already has no delivery. Moreover, such a service likely covers a small % of the market as it is tailored to heavy rideshare users

What can JET do to counter: already offer $0 delivery fee. Work with other rideshare companies as well to create a subscription service (e.g. Lyft with GRUB)

- White-label delivery (allowing chains to offer delivery through their own app under their own brand)

Pro: align with the chains to offer a differentiated value prop (unique items or lower cost). The brand gets to tap an established logistics network and the logistics network get to capture demand

Con: this might just be the worst thing a food delivery company can do in the long-run, especially one that is dependent on chains. The platform becomes a commodity and capture a small fee for each order, and there is no benefit of customer acquisition. At some point, all the food delivery platform would do this and the chain restaurants (large % of logistics order) will simply funnel it out to the lowest cost vendor

What can JET do to counter: it would be ideal if competitors do not do this as it would be better for JET to capture a fee for offering the logistics in the future. However, if competitors do it, this basically ensures JET long term victory as it means competitors are giving up their inventory and has resigned to be a commodity (note that Deliveroo is already doing this with Nandos)

So, what does all of this mean?

This means that JET is very likely to win Europe and that the company will be incredibly profitable/valuable once it wins. It will instill a delivery fee (as in Netherlands and Germany) once it wins and likely minimum AOV to increase restaurant commission rate.

Please contact me in twitter if you think I am missing something.

I’m glad there are actually people reading my stuff (honestly thought nobody cared), and have received interesting inputs. Also, thanks to those that sympathize with my student loans situation. I’m adding a donation button below. If you find value in my work, help out by buying me shares in $TKWY (or wine as I write these posts at night with several glasses of wine).

Links to other related companies:

what are your thoughts on the sare price movement in recent days?

Jet isnt free anymore, they have increased their fee to 1.5 euro per delivery.