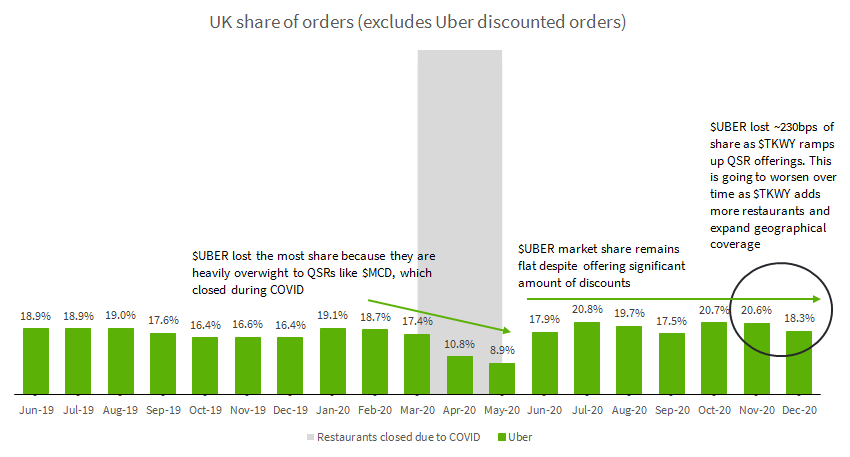

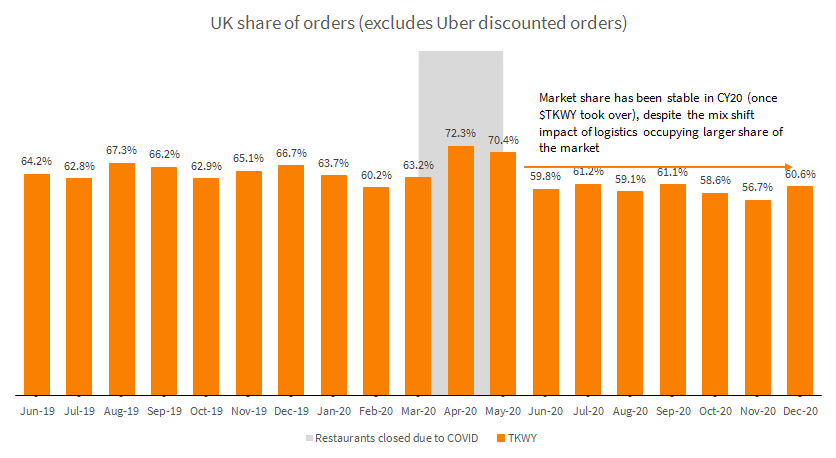

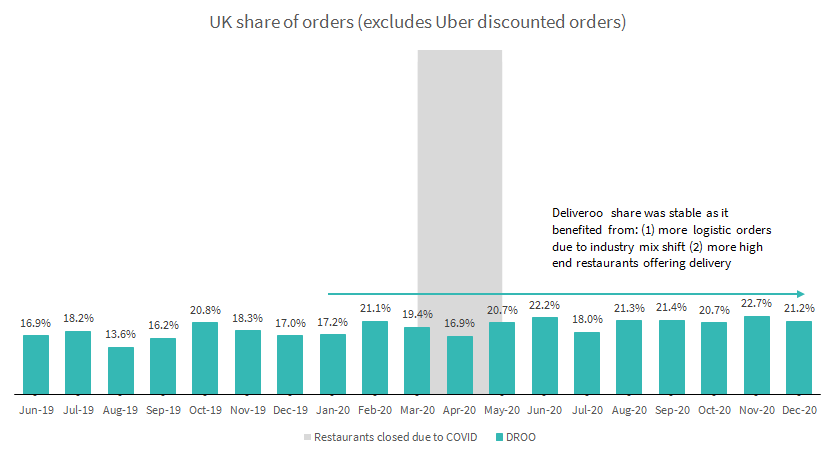

Before we delve further, let’s have a look at the current UK food delivery share. In contrast to popular narrative, $UBER and Deliveroo have not gained share from $TKWY. This is despite being in the best position to take advantage of market environment (COVID). $UBER share of orders has been flat once we remove discounted orders.

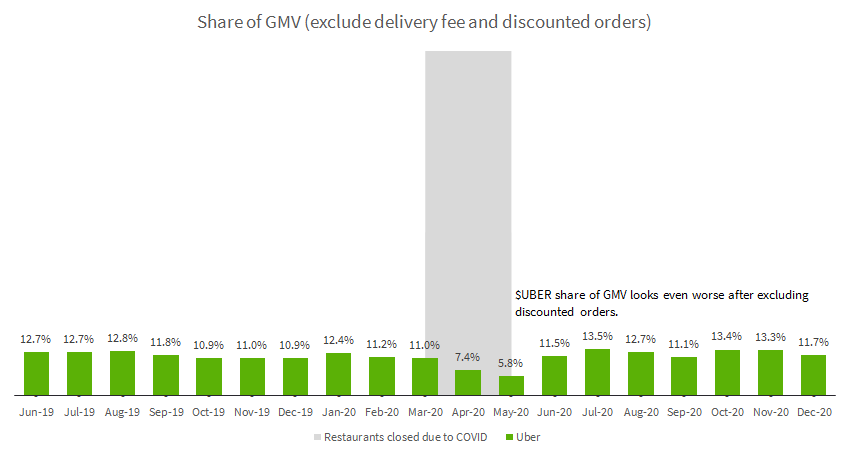

Also note that $UBER share has not grown at all even with all the aggressive voucher discounts. The discount strategy simply doesn’t work on a standalone basis.

Uber

To reiterate from my previous post, $UBER market share is really a mirage of a willingness to incinerate cash and accept vastly unfavorable terms (maintain low teens share of GMV).

Just Eat Takeaway

Despite suffering from industry headwinds (mix shift towards more logistic orders - further discussion on this in my upcoming posts). $TKWY market share has been stable since COVID.

Another point to note is $TKWY share gain in December due to the launch of logistics, is likely to come at the expense of $UBER ($TKWY launched with QSRs in December 2020, since $UBER gets most of its orders from QSR, it was affected the most).

Deliveroo

Deliveroo share was stable as it mixes towards high-end restaurants, which $TKWY does not yet have. As $TKWY pushes into high-end restaurants, we should expect to see share decline. An important thing to note is Deliveroo benefited from the tailwind for groceries delivery. It might be small, but likely to have contributed 1-2pts of order share

What can Uber do to survive?

$UBER is, clearly, the #3 player in the market once we account for discounted orders, they are likely to incinerate more cash than Deliveroo once we remove delivery fee. To make things worse, their orders are most susceptible to being captured by $TKWY, given the high QSR mix ($TKWY has $MCD now)

So what can $UBER do?

Here is what I expect Uber to do - go after high end restaurants. Doing so, $UBER can increase its AOV and take rate, bringing its unit economics closer to Deliveroo. Strategy wise, $UBER will, likely, repeat its discount strategy - offering discounts for orders with high end restaurants. Meanwhile, $TKWY will continue its low delivery fee approach.

But hey, where does that leave Deliveroo?

Links to other related parts:

Links to other related companies:

Thanks for the very detailed write-ups on JET and its competitors. I get the argument of JET vs Deliveroo vs UBER, but I'm wondering if this squeezing each other out of the business of sorts is symptomatic of the overall market not being big enough to support this business?

Fundamentally, food delivery must be incremental profit (not only revenue) to the restaurant or it doesn't make sense to use it. Net of the take-rate, the economics to restaurants can be quite poor. And most food delivery platforms pay their workers very badly as well, so in essence the story of food delivery platforms adding incremental value to the system has mainly resulted in platforms earning but at the expense of other stakeholders (restaurants, delivery staff). My guess is perhaps it's not developed or mature enough? But can understand with more usage it should start to work. Curious to hear what you think.

Just wondering whether there could be a win-win situation for all stakeholders and what margins food delivery would stabilize at.