“If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.” - Warren Buffett

Growth could be a disaster for Deliveroo as the business struggles with multiple headwinds in 2H21 and 2022. Gross profit could easily decline by more than 50% with conservative assumptions, and potentially much more.

The first three are things that are very likely to happen:

Overall logistics delivery demand mean reverts as people step out to dine-in

Deliveroo loses share due to increased competitive pressure from $TKWY

AOV excluding delivery fee reverts as large order frequency declines

The next four points are things that might have happened:

Deliveroo reduced delivery fees to compete against $TKWY, or it might elect for the slow bleed (maintain delivery fees and lose share)

Take rate reduced due to increased competition from $TKWY

Courier cost increased as takeout demand got replaced by dine-in demand (leading to longer waiting and travel time). Deliveroo needs to compensate couriers by offering higher payout per order

Potential impact on courier cost per hour due to the new rulings, although this probably takes time to materialize

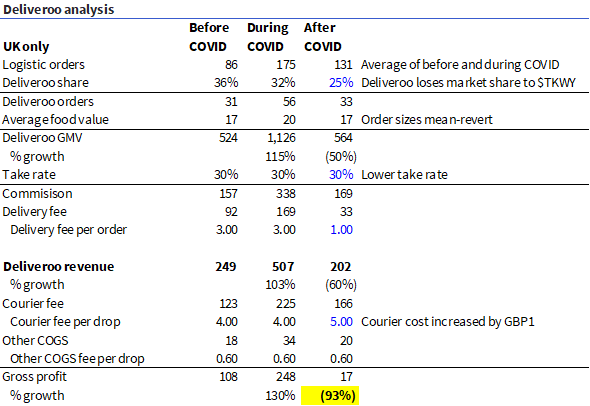

Since Deliveroo’s post-COVID financials aren't out, I made logical and conservative assumptions (for the UK business) to construct, what I believe, are the company’s financials.

Shown above assumes only #1 - 3 happened, and how that might impact Deliveroo’s UK business. We can assume a similar situation is happening across Europe, although the degree differs. The key thing to note is: with only three conservative assumptions (that most will agree on), gross profit would already decline by 53%.

If I were to layer on things that could have happened (#4 - 7 stated above), one could easily get to an apocalyptic situation for Deliveroo.

For instance (#4), simply dropping the delivery fee from £3 to £1 would further slash gross profit by 45% from an already depressed level.

(#5) Lowering the take rate to retain restaurants could further reduce gross profit.

(#6) Higher courier fees would bring gross profit down close to 0.

As for #7, it is plausible that the new UK ruling would increase courier fees by a substantial amount (from Deliveroo's current levels to min wage). This increase would further shrink Deliveroo’s existing courier supply — couriers will churn to platforms that pay minimum wage (Deliveroo courier pool expanded as many became unemployed due to COVID).

If all 7 points were true, one could easily bridge to a catastrophic outcome for Deliveroo. Now, why would any firm be willing to invest in Deliveroo prior to the debacle is beyond me.

How about $TKWY? Would it see a similar impact?

No. But It would definitely see a growth slowdown.

$TKWY marketplace orders are convenience based (sticky demand) as opposed to substitution based (one-time demand — mostly due to COVID). Hence, COVID did not result in a massive increase in marketplace demand (from a percentage growth perspective) as the initial base was already high.

Shown below is an example of what I mean. Before COVID, marketplace restaurants have already been receiving huge amounts of orders (relative to logistics). When COVID happened, the percentage increase in the number of orders were relatively smaller than logistics, because of the higher base. However, this also means that any normalization in demand will have a much smaller impact on growth.

Furthermore, $TKWY would continue to benefit from channel shift (phone to online orders) which buttresses any normalization growth decline. On the flip side, logistics orders do not have such cushion (no channel shift as orders are definitionally 100% online), therefore decline will be 100% decrements.

Lastly, $TKWY benefits from share gain within logistics restaurants (100% incremental as $TKWY grew from a small base). All in all, $TKWY total order volume could actually increase.

Now, I need to make this clear. ALL of the examples above are completely illustrative, but it is a good representation of my point. $TKWY could still grow at 20%+, while peers see apocalypse.

Quick thoughts on valuation: How much is Deliveroo valued on a normalized basis?

Let’s do some quick calculations:

Deliveroo printed ~£190 GP in FY19

Suppose it 2x its GP due to COVID, it could be ~£400m GP in FY20

Given what we discussed above, Deliveroo can easily see ~50% decline in gross profit, if not WAY more

This puts Deliveroo at ~£200m normalized GP

At £7bn valuation, that is ~35x normalized EV/GP

If I had to guess, that valuation is probably a tad too high for a business that is sub scale in all of its markets, while competing against an incumbent ($TKWY) which has:

A superior product (greater restaurant selection)

A growing warchest to self-finance a long-term delivery war (marketplace gross profit, with cash flow from Netherlands and Germany, and a massive cash balance)

An advantaged cost structure (marketing and corporate overhead scales)

Also, Deliveroo's business model might be illegal in many of its key markets soon, which might cause massive business disruption and break Deliveroo’s unit economics (negative normalized gross profit is possible). Note that once the UK passed the rulings, other countries followed like clockwork, all over the last 2 weeks.

UK: https://www.bbc.com/news/business-56123668

By my estimates, the above countries probably represent 80% of Deliveroo’s European business. At the rate of how things are developing, I’m placing my bets on more of such to come.

Where might I be wrong.

Now, where could I be wrong. There are a couple of levers that Deliveroo can pull to cushion the impact, albeit self destructive.

Increase take rate — Deliveroo leverages its negotiating power against restaurants during COVID. If so, this increases restaurants willingness to churn when $TKWY steps in with lower take rates

Increase delivery fee — this improves $TKWY free delivery value proposition

Reduce courier cost/drop — Deliveroo took advantage of its expanded courier labor pool. If so, it simply aggravates the current situation (referring to the new rulings), and sets the company up for a future collapse

That said, there appears to be some investors willing to pay up for this declining and structurally challenged business. I think we know who is the patsy at the table.

In the next post, I will talk about Deliveroo’s cash runway. The answer: not much.

Links to other related parts:

Links to other related companies:

What is to stop the logistics companies from mirroring TKWY’s marketplace model? I don’t see any counter positioning issue to cannibalisation of the logistics model?