Deliveroo part 8 - The aftermath

“I wish good luck (not really, you brought this on yourself) to any investor that decides to participate in DROO’s IPO” - Newmooncap

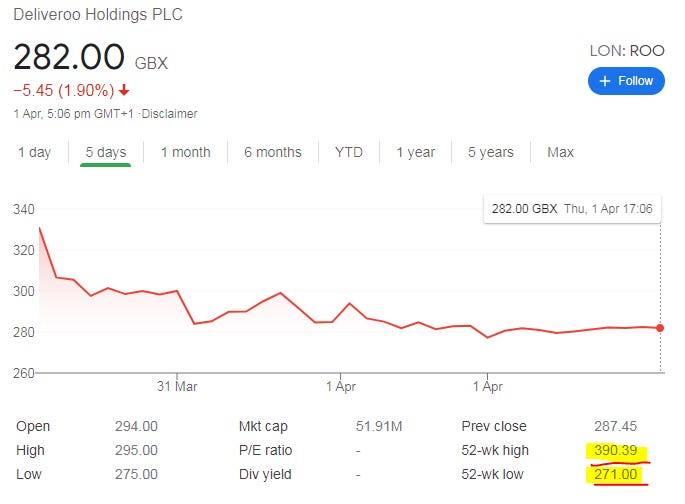

Looks like the market has some sense after all.

This post is meant to close off the Deliveroo series. I’ll still touch base every quarter, covering key data points and changes in the business that might influence its long term future. However, there probably isn’t enough new information coming out of the company outside of the quarterly reports that warrant regular posts.

$ROO is still a short

As with most shorts, it is as much about the long term future as it is about figuring out fund flows and understanding the necessary data points that would give us certainty of the future. $ROO is still trading at a $DASH like multiple but is clearly not of the same quality given the lower growth and higher risks.

I think the second half of 2021, perhaps September, might be a good time to short the stock (if it’s still trading around the same level) as that is when we will see the confluence of both negative fundamental and technical factors. I rarely short stocks but if it is still trading around the current level I might do so. Here is my logic:

Fundamentals

Fully lap the effects of Covid: First half 2021 would still benefit from the inflationary effects of Covid, and growth would still be strong as it laps periods where many of its main suppliers like Mcdonald’s, Nando’s, and Wagamama were closed. Second half 2021 probably sees demand plummet as Covid fades and Europeans dine out more during summer, while lapping quarters where the company saw big increases in demand and average order value. I expect order demand to drop and average order value to sink as families revert to on-premise dining. I also expect to see higher courier fees as restaurants begin to prioritise dine in customers again, leading to longer courier wait time. We might also see more refunds and complaints as a result, which further impairs unit economics. As mentioned in my previous post, I expect to see a 50% decrease in contribution profit1 (this is not the same as their gross profit definition), just from the above, without any impact from cutting delivery fees or take-rate to compete with $TKWY

$TKWY in full swing (#ProjectBulldozer): $TKWY would have probably closed much of its restaurant selection gap relative to $ROO by now, and would become a more potent competitor. This would pressure order demand for $ROO and S&M be it in the form of a voucher or marketing. $ROO could try to compete against $TKWY by lowering its delivery fee, but that just brings contribution profit1 well into the red, and the business model will become evidently unviable

Impact from labour model switch: it will be the first quarter where we will see the full effects of the labour model switch in Italy and Spain, adding further uncertainty. This will probably weigh on the stock for a few quarters as even the bulls will hesitate to plow further capital without visibility on how the labour model switch might affect the business, disruption risk or unit economics. I think it would be moderately negative to $ROO’s already untenable unit economics. We might also see the effects of the fines and legal costs on the business model now. It would be interesting if the company raised £1bn in capital from investors just to give half to lawyers and regulators in fines to protect their already untenable business model

Technicals

Lock up expiry: I expect many of $ROOs backers would be looking to sell their stock after the 180 days lock up. Many of them already sold a sizable chunk of their stake into the IPO. Remember that none of them backed $ROO when it almost went bankrupt during Covid. That was the opportune time to take a chunk of flesh at attractive economics but none of them did. That says a lot.

Couple of signposts that I will also be looking out for:

$ROO loses share in its core London market, and is unable to expand into $TKWY-strong regions as $TKWY closes any restaurant selection gap

$ROO pivots to groceries or white label delivery, or into countries like France or the UAE where it doesn’t have to face a strong $TKWY

$ROO invests in more “differentiated” verticals like dark kitchens or dark stores in an attempt to differentiate itself from $TKWY

All these signs will suggest that $ROO is losing the war.

How bad could it get?

How much more downside is there from here? It sort of depends on what the company decides to do going forward. The company might still be worth quite a lot if it decides to refocus its capital to try to win markets where the company is strong but $TKWY is weak like France, but I suspect they are just not going to do that. It is a politically unpopular decision. Doing that will tank the stock in the near term. If $ROO decides to maintain its existing strategy, well...then it probably wouldn't be worth much. $WTRH trades at 3x LTM gross profit (and remember that $ROO gross profit is significantly overstated) and does not have the same legal risk as $ROO.

As I have said, Deliveroo reminds me of Blue Apron ($APRN). They are both companies that optimised their business to extract maximum value in an IPO by selling $1 for 80c, as opposed to building any long term moat.

Both depended on the capital market to finance their growth, and made the mistake of overpricing their IPO, impairing credibility and putting them in a position where they have to prove themselves, just as competitors are ramping up and growth slows.

As growth slows and/or unit economics remain poor, the stock will continue to slide and the capital market will shut on the company, effectively sealing its fate.

However, it is possible that growth will remain strong for one or two quarters as $ROO continues to benefit from the last vestiges of Covid and lap very weak quarters, but the proof of the pudding will come in the second half of 2021.

By the way, isn’t it interesting that $ROO (and $UBER) saw massive demand destruction in March and April 2020? That shouldn’t have happened if consumers really went to the $ROO and $UBER app to discover restaurants to order food, because demand would have simply shifted to restaurants that were open. The fact is order volume collapsed because people only wanted Nando’s or Wagamama but couldn’t find it on $ROO or $UBER as the restaurants were closed. This did not happen for $TKWY. This is evidence that consumers do not go to $ROO or $UBER to find food but merely fulfillment, and therefore they do not generate much value in the discovery piece (the most valuable) of the value chain.

Also, if I was Jitse, I might want to offer a Pan-European white label deal to some chains with some small economics in exchange for multiple year exclusivity. $TKWY is the only one able to offer such broad geographical coverage which makes it valuable. By doing this, they would shrink competitors’ inventory and basically make it impossible for new entrants to scale into new markets. It’s a win win.

I will be starting a new series soon (on a company whose name rhymes with Yolo). So stay tuned.

Peace.

Links to other related parts:

Deliveroo part 4 - Hell is coming. Gross profit might decline by more than 50%

Deliveroo part 3 - How did Deliveroo managed growth in the past

Links to other related companies:

Contribution profit = gross profit + variable operating cost (merchant / customer / courier management cost)