$ROO reported its 1Q21 results. There were a couple of interesting data points but it was within my expectations

Misconception on 1Q21 orders growth

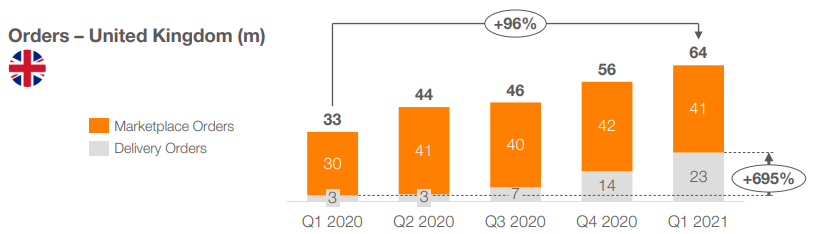

The one thing that I knew people will get “excited” about was the order growth rate of the UK business. Order growth in 1Q looked high at 121% and uninformed investors got excited. It looked like an acceleration.

“However, it is possible that growth will remain strong for one or two quarters as $ROO continues to benefit from the last vestiges of Covid and lap very weak quarters, but the proof of the pudding will come in the second half of 2021.” - Newmooncap

I will reiterate my point. The 121% growth figure was a result of lapping easy comps (Covid started impacting $ROO in 1Q20). Another refresher — remember how $ROO went crawling to the CMA begging for the Amazon cash? That’s because many of its restaurants closed when Covid hit, and demand evaporated for the month of March.

$TKWY saw a slowdown as well but to a much smaller extent. There were two reasons for this:

Pantry stocking — people filled their kitchen with food in anticipation of the apocalypse, which led to a reduction in food delivery, as these people eat their pantry food first

Restaurants closure — forced closure of restaurants was an obvious reason for the reduction in number of food orders, but would only be impactful if these restaurants were a meaningful driver of demand

$TKWY was impacted by the first but not the second. Whereas $ROO was impacted by both.

“By the way, isn’t it interesting that $ROO (and $UBER) saw massive demand destruction in March and April 2020? That shouldn’t have happened if consumers really went to the $ROO and $UBER app to discover restaurants to order food, because demand would have simply shifted to restaurants that were open” - Newmooncap

The fact that $ROO was impacted by both is evidence that people really use its app to fulfil demand, and as such these branded restaurants have tremendous negotiating leverage against $ROO. This further reinforces my point on the threat of white label delivery. ($UBER was impacted more by this than $ROO, which suggests that $UBER is more levered to QSRs)

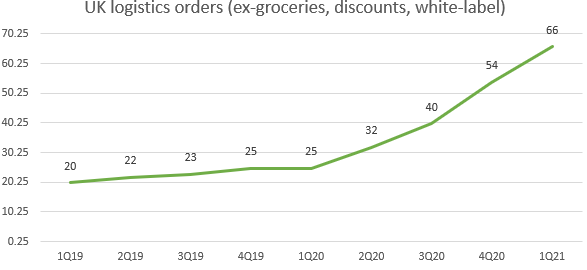

If you remove groceries, discounts, and white-label, order growth would quickly go from 121% to low 70%. These are of course my estimate, but considering that groceries is now 10% of the business when there was nearly nothing back last year, that suggests that groceries added least 20 points to growth. Now, if we layer on discounts and introduction of white-label…

Even at low 70%, this growth figure is still elevated as it is really just the effects of peak demand (Covid is ending) lapping trough demand (Covid impact in 1Q20). Order volume from a sequential basis is likely down if we exclude groceries, white-label, and discounts.

$ROO FY21 guidance

The more important piece of information is that management decided to maintain its guide, suggesting that we will see a massive growth slowdown in 2H21. It actually implies that underlying food order growth excluding groceries and white label is probably going to be quite negative. Some investors might think this is simply them being conservative (which was reiterated in the press release), but a top down build would suggest it makes sense and in fact might actually be a tad too aggressive.

These are my assumptions:

Industry demand for food delivery (before vouchers, groceries, and white label) will decline after Covid, but still remain much higher than what it would’ve been without Covid

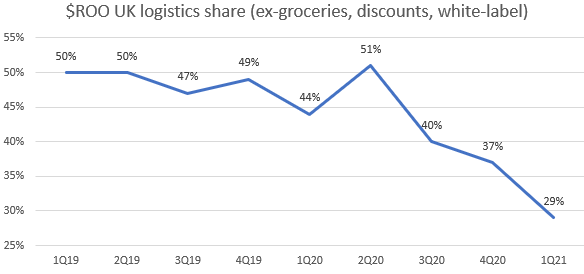

$ROO share remains stable from current level. This is probably too high because the company has already lost so much share over the past 6 months.

AOV returns to pre-pandemic level, while delivery fee per order remains stable at $2

Groceries orders continue to grow sequentially

$ROO continues its discounts and white label strategy

*I haven't had time to clean up my model and create pretty charts so I would not be posting the outputs for now. I might do so in the future

There is downside from here as I assumed stable market share for $ROO. Continued share loss would mean $ROO would actually miss guidance.

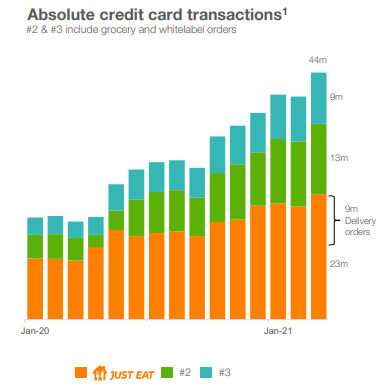

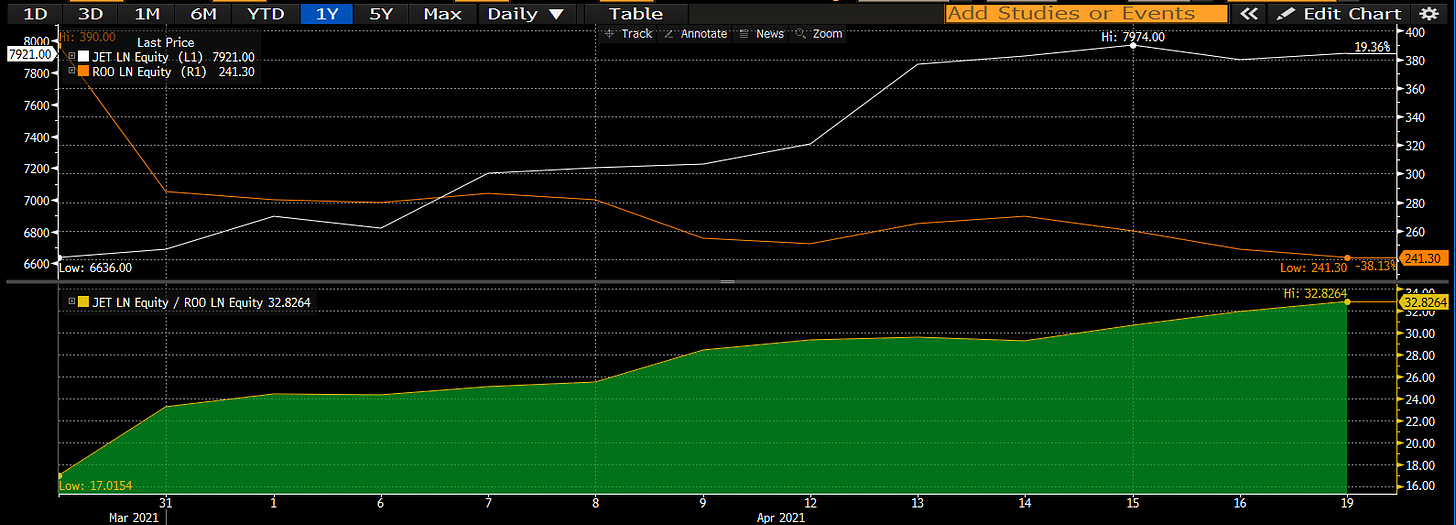

The above share loss looks almost unbelievable. But it isn’t, when compared to total industry order growth. Although I would caveat that the comparison is not completely fair as $TKWY has been expansionary to the TAM.

$TKWY data which uses information from Cardlytics suggests a similar share loss, but with market share being much lower. I used both $ROO and $TKWY reported data to piece together my own estimates above.

There’s simply no way $ROO will avoid share loss as $TKWY enters its markets. The effects of share loss will be greater in areas where $TKWY is already strong.

$ROO must either cut its delivery fee or start offering more discounts to stay competitive (which might only slowdown the rate of share loss). The former will cause it to miss the guide because AOV includes the delivery fee, while the latter wouldn’t as I think promos are in S&M. Guess what the company has elected to do?

Does $ROO have enough cash?

Gross profit % GTV is going to collapse in the 2H21 (AOV plummets with fixed courier fee per drop)

Marketing cost is going to step up due to more discounts

Courier and staff (rehire to acquire restaurants) recruitment cost is going to increase as the economy reopens

In short, I expect $ROO to continue burning cash at a very high rate, and will accelerate if it decides to match $TKWY $0 delivery fee strategy.

Here’s a back of the napkin math on $ROO cash burn rate:

$ROO has about £1.4bn of cash post IPO, of which 150m is revolving credit, leaving us with £1.3bn of net cash

There are about £100m of existing legal liabilities and maybe £200-300m more from Italy and Spain alone, leaving us with £900mn-1.0bn of cash

$ROO did EBITDA % GTV of (9%) in 2019, it is possible they do (5%) in FY21 given guidance + reinvestment, implying £250m of cash burn (based on guided GTV)

Implies that $ROO will be left with £650-700m of cash by end 2021 with lower market share position (does not match $TKWY in this case and so bleeds share)

Also, remember that a big chunk of the company’s cash balance does not belong to the company and is really float (restaurants’ cash). People pay $ROO for food, and $ROO takes time to pay the restaurants. As $ROO loses share, that negative working capital position would unwind against them. I estimate that this is about £200m of cash.

This puts $ROO at about £500m of unencumbered cash by the end of the year. Not a very long cash runway.

Note that the above calculation does not assume more legal liabilities coming out of countries such as the UK and France, which is where the potent legal liabilities could emerge given their presence. $ROO might have to pay £300m in fines in Italy, and the UK is probably >3x the size of Italy. France might be 2x. We don’t really know the real scale because $ROO does not give us financial details, but these countries are certainly much larger and would certainly involve bigger fines.

So by the end of 2021, what we will have is a company that is:

Losing market share

Unlikely to grow GTV meaningfully in 2022 given tough comp

Very unprofitable with no visible path to profitability

Around 1 year of cash left

Massive off-balance sheet liabilities that might sink the business operationally (changing labour model in its two largest countries) and financially (fines will bankrupt the company)

How any investor has any confidence owning $ROO is beyond me. We are talking about a company which will not have any growth till 2023 and by which time would not have much cash in the balance sheet.

If $TKWY continues to gain share from $ROO as it has over the last 6 months, then there is no chance for $ROO to see any growth even in 2023 (at least without blasting through its cash balance at an even faster pace).

My prediction is that it would be evident that $ROO is dead by the end of 2021 or maybe mid 2022. The stock price is already starting to reflect this reality. However, Q2 might continue to be strong as April 2020 was also weak for $ROO and so the company would still benefit from easy comps.

Links to other related parts:

Deliveroo part 4 - Hell is coming. Gross profit might decline by more than 50%

Deliveroo part 3 - How did Deliveroo managed growth in the past

Links to other related companies:

What are your thoughts on Uber Eats entering Germany?

Any thoughts on H1?